Popular posts from this blog

S&P runs alongside channel resistance; ready to accelerate

- Get link

- X

- Other Apps

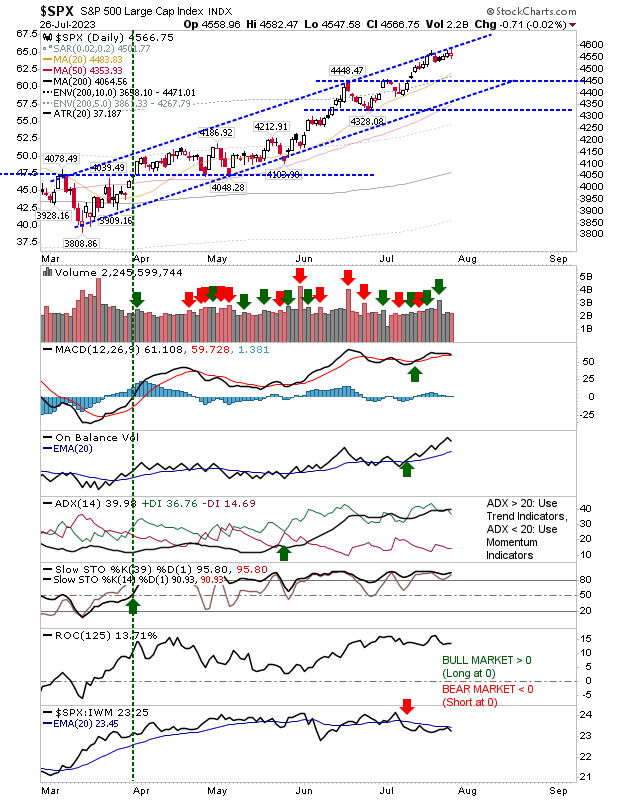

The headline would have been a small loss, but S&P action over the past week and a bit has been for an index running alongside upper channel resistance, looking ready to break through higher. Technicals remain net positive, although the MACD is close to a new 'sell' signal. Even if this was to materialise, I would be surprised if it brought any serious selling and may offer a better buy-the-dip opportunity.

The Russell 2000 ($IWM) didn't experience the modest selling of the S&P and Nasdaq, and managed to post a decent enough white candlestick, but buying volume was relatively light. It's still a slow burn in the bullish relative performance shift versus the S&P, but On-Balance-Volume is moving more strongly in bulls favor. More significant is weekly resistance at $197, but we need to see what happens on Friday to confirm this.

The Nasdaq had pulled back from its last tag of channel resistance, so it had perhaps a little more 'value' to offer potential buyers than either the S&P or Russell 2000 ($IWM), but it didn't deliver on this. The MACD trigger remains on a 'sell' with a bearish divergence, and, its underperforming relative to the S&P. Vacation volume clouds the issue a little, but it looks like buyers want to go for Large Caps over Tech stocks.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.

- Get link

- X

- Other Apps

Popular posts from this blog

Upcoming "Death Cross" for Russell 2000 ($IWM)

"Dead Cat" Bounce or Something Better?

"Bull Traps" For S&P, Nasdaq and Bitcoin

Archive

Archive

- April 202511

- March 202511

- February 20259

- January 202510

- December 20248

- November 20247

- October 202412

- September 202411

- August 20246

- July 202413

- June 202410

- May 202411

- April 202415

- March 202410

- February 202411

- January 202413

- December 202310

- November 202311

- October 202311

- September 202311

- August 202312

- July 202311

- June 20235

- May 202313

- April 20239

- March 202313

- February 202312

- January 202312

- December 202213

- November 202210

- October 202212

- September 202213

- August 202212

- July 20221

- June 202212

- May 202213

- April 20229

- March 202211

- February 202211

- January 202213

- December 20219

- November 202112

- October 202113

- September 202111

- August 202110

- July 202114

- June 202112

- May 202113

- April 202113

- March 202114

- February 202111

- January 202112

- December 20209

- November 202012

- October 202012

- September 202014

- August 202011

- July 202010

- June 202013

- May 202012

- April 202014

- March 202015

- February 202011

- January 202012

- December 201910

- November 201912

- October 201913

- September 201913

- August 20198

- July 20198

- June 201912

- May 201912

- April 201914

- March 201913

- February 201911

- January 201914

- December 201810

- November 20187

- October 201814

- September 201815

- August 201810

- July 201813

- June 201812

- May 201815

- April 201816

- March 201813

- February 201812

- January 201814

- December 201711

- November 201718

- October 201717

- September 201715

- August 20178

- July 201713

- June 201716

- May 201715

- April 201715

- March 201720

- February 201710

- January 201718

- December 201614

- November 201617

- October 201612

- September 201610

- August 201614

- July 20163

- June 201616

- May 201618

- April 201618

- March 20168

- February 201620

- January 201620

- December 201513

- November 201518

- October 201516

- September 201518

- August 201517

- July 201519

- June 201518

- May 201521

- April 201520

- March 201522

- February 201518

- January 201518

- December 201413

- November 201417

- October 201420

- September 201421

- August 201420

- July 20148

- June 201420

- May 201420

- April 201421

- March 201420

- February 201418

- January 201422

- December 201320

- November 201321

- October 201322

- September 201325

- August 201317

- July 201311

- June 201320

- May 201317

- April 201319

- March 201318

- February 201324

- January 201321

- December 201218

- November 201223

- October 201224

- September 201225

- August 201225

- July 201215

- June 201218

- May 201224

- April 201225

- March 201222

- February 201219

- January 201217

- December 201114

- November 201119

- October 201121

- September 201119

- August 201122

- July 201121

- June 201120

- May 20117

- April 201119

- March 201125

- February 201121

- January 201125

- December 201019

- November 201021

- October 201022

- September 201025

- August 201010

- July 201029

- June 201025

- May 201022

- April 201022

- March 201030

- February 201023

- January 201026

- December 200922

- November 200923

- October 200923

- September 200926

- August 200927

- July 200921

- June 200939

- May 200932

- April 200939

- March 200936

- February 200933

- January 200935

- December 200823

- November 200823

- October 200821

- September 200821

- August 200822

- July 200823

- June 200828

- May 200823

- April 200822

- March 200828

- February 200824

- January 200826

- December 200719

- November 200721

- October 200729

- September 200724

- August 200729

- July 200720

- June 200734

- May 200742

- April 200740

- March 200734

- February 200738

- January 200732

- December 200635

- November 200630

- October 200650

- September 200646

- August 200641

- July 200648

- June 200637

- May 200653

- April 200645

- March 200648

- February 200645

- January 200635

- December 200543

- November 200535

- October 20058

- September 20058

- August 20059

- July 20057

- June 200510

- May 20053

- April 200510

- March 20058

- February 200516

- January 200529