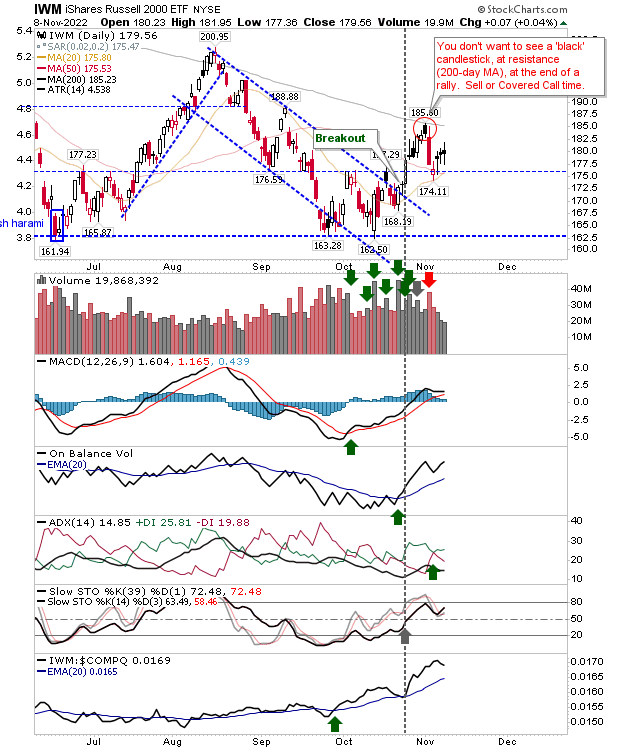

Markets struggle in advance; neutral doji / spinning tops abound

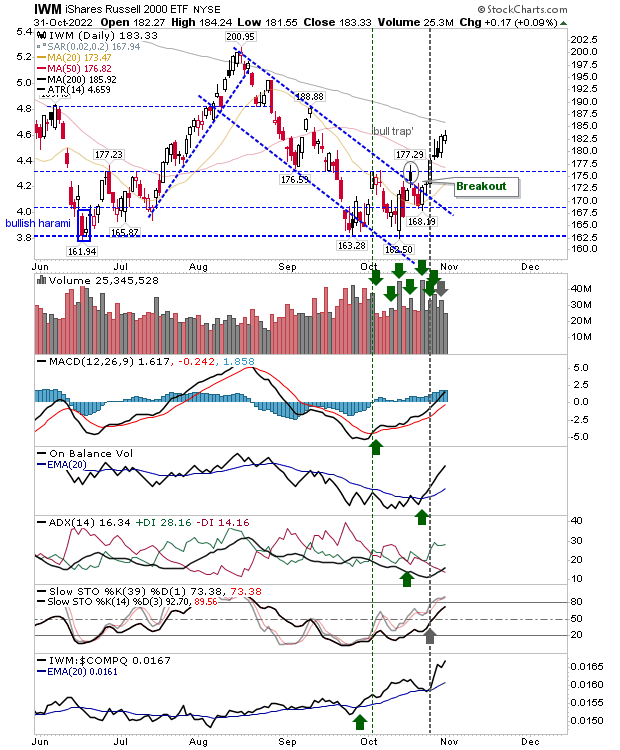

Markets gain, but they are hardly convinving. The Russell 2000 ($IWM) is the best example as it posts its fourth day of doji/spinning top candlesticks - which post a net gain - but do so from a point of indecision. Technicals for the Russell 2000 are still net positive, but I'm expecting a big red candlestick anytime soon. Note the falling buying volume, another reason to lack confidence in the current advance.