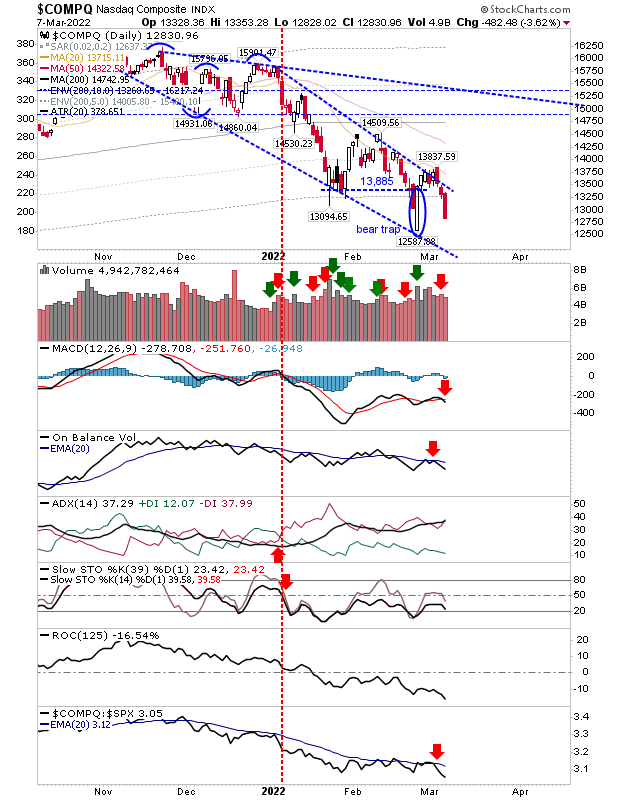

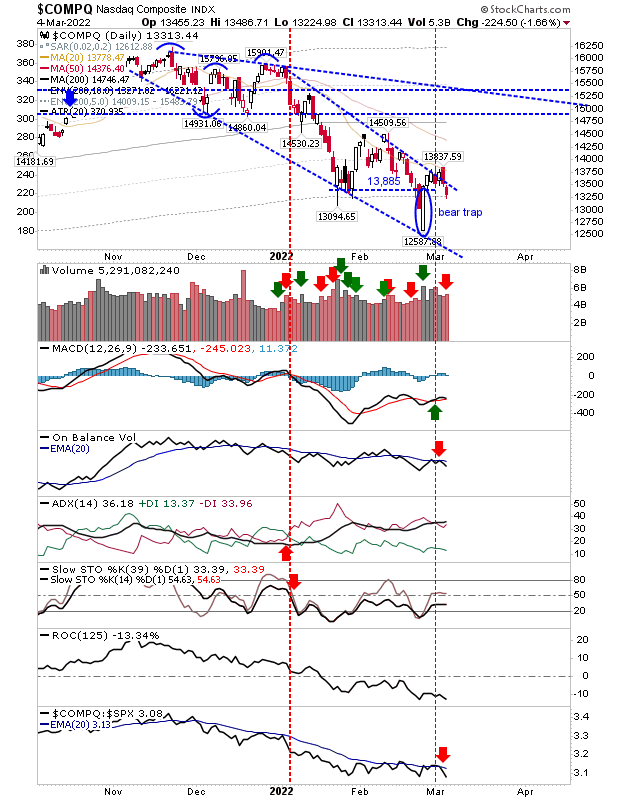

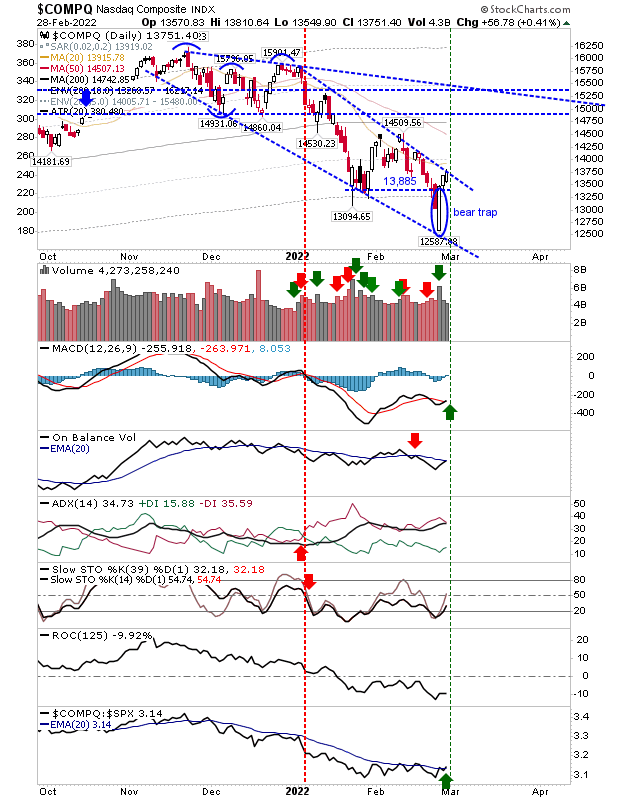

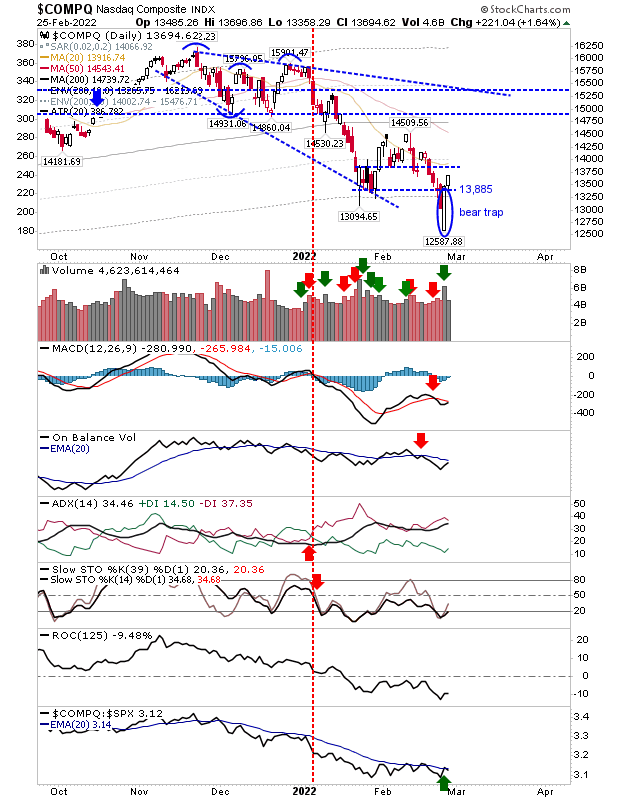

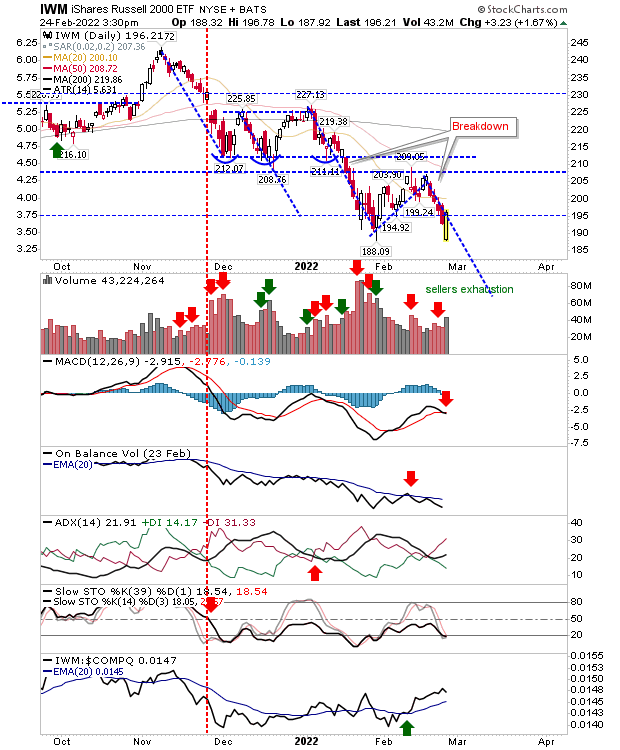

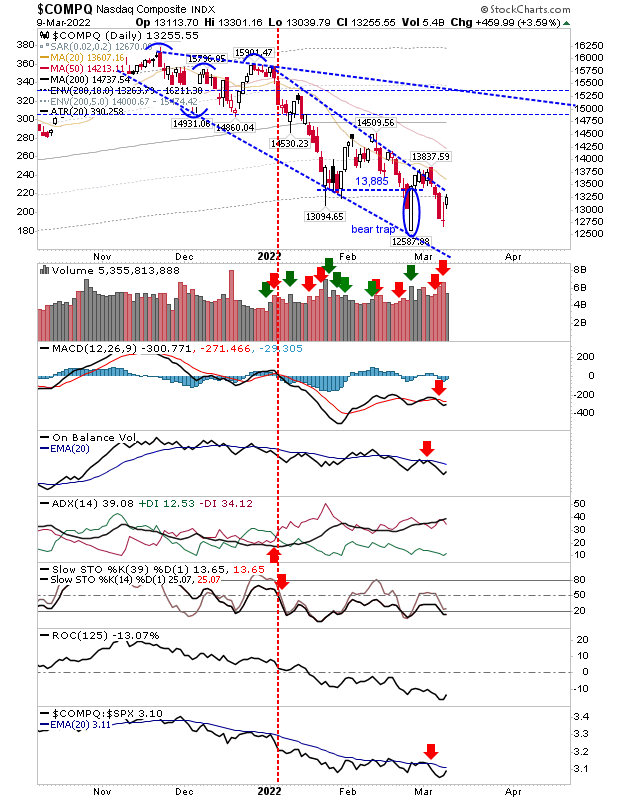

Bullish reversals, but markets not out of the woods.

Just as the selling meant indices were not as weak as headlines suggested. Likewise, today's buying was not as good as the media would suggest either. However, it did at least stall the break of the most recent swing low. The Nasdaq has made its way back to declining resistance of the slow forming wedge, but technicals are all bearish and it remains some way from a bullish 'buy' in relative performance to peer indices.