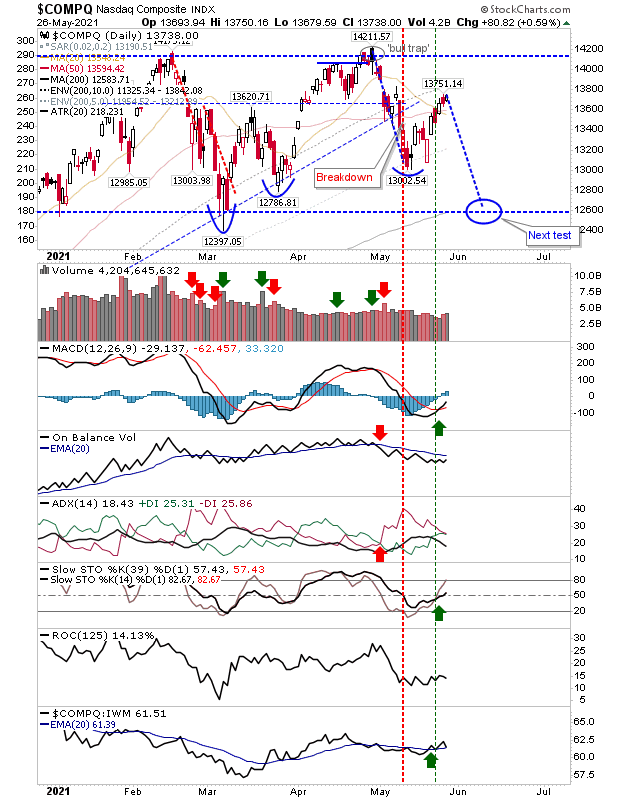

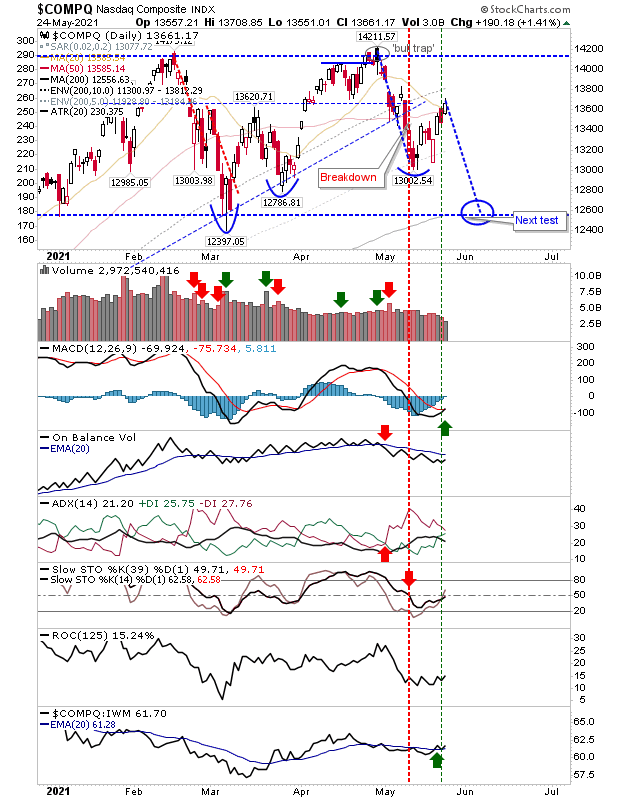

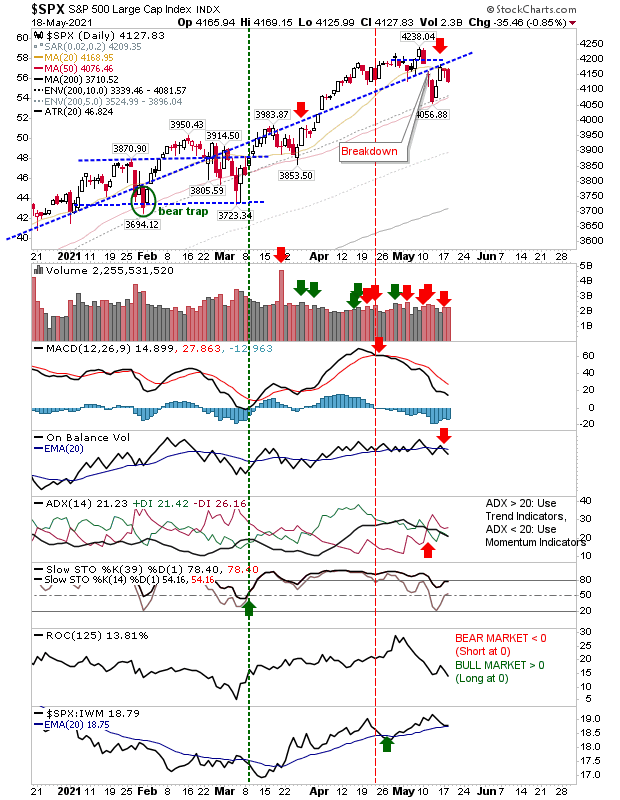

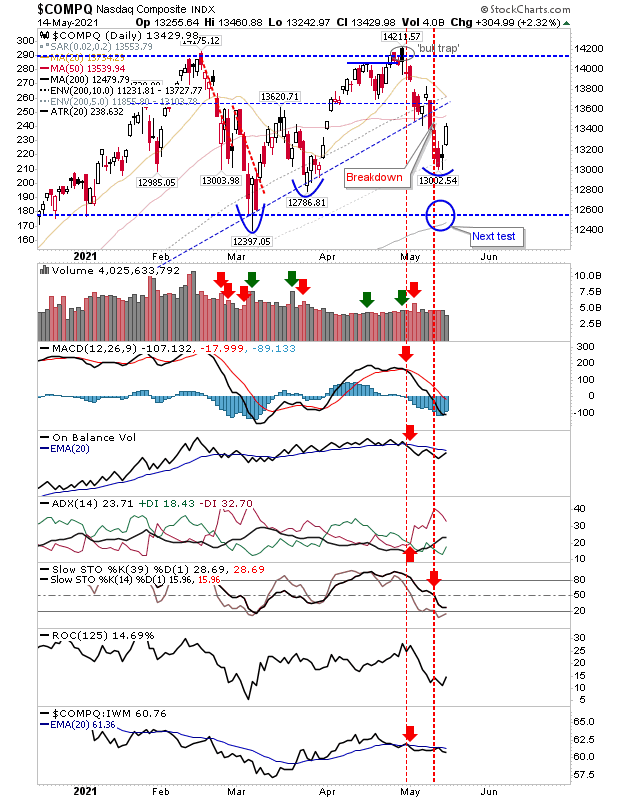

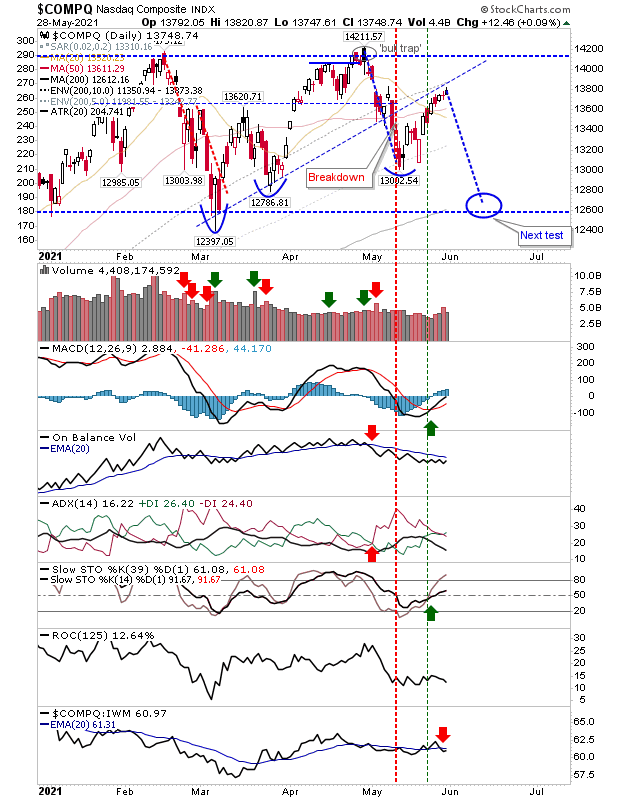

Relief rallies now at a crawl, but Russell 2000 net bullish

The bounce is struggling to attract buyers with Friday's close registering as a small gain with low volume. In the case of the Nasdaq, the measured move lower would deliver a tag of the 200-day MA, making it an attractive forecast. Technicals are mixed with 'buys' for the MACD and Stochastics, offset by relative performance shifting back in favor of Small Caps.