Friday's recovery sets the groundwork for a swing low

Friday marked the beginning of potential swing lows for the indices, although it will take more than one positive day to confirm such lows.

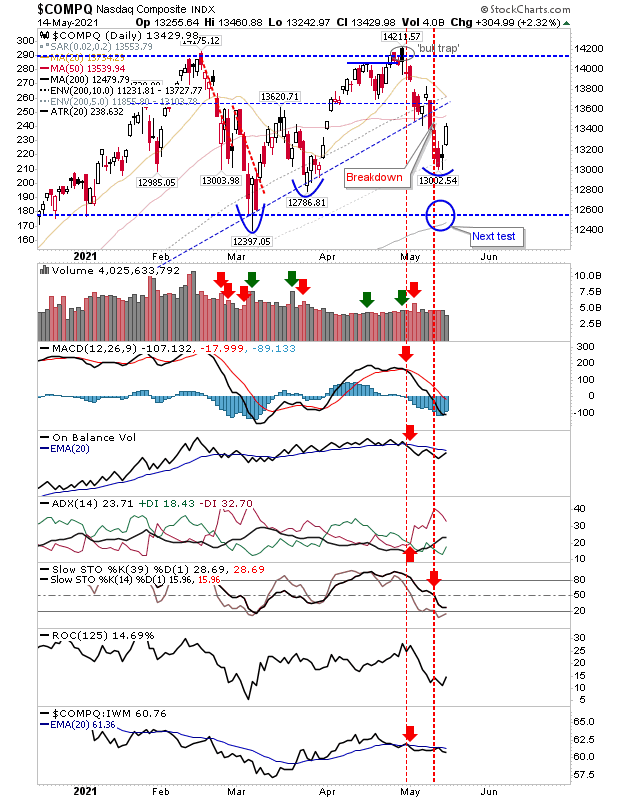

The Nasdaq is bearish across all supporting technicals including relative performance against the Russell 2000. The next test for this rally is the 50-day MA and converged trend support and 20-day MA.

The S&P has rallied back to former trendline, now resistance. Technicals are mixed with bullish On-Balance-Volume and Stochastics offset by bearish ADX and MACD.The Russell 2000 will be testing converged 20-day and 50-day MAs within the bounds of a trading range. It has an unusual scenario of net bearish technicals, while outperforming the Nasdaq. Until the range is cleared, current action is just noise.

So, Friday's action was good to see - but it doesn't change the challenge as the Nasdaq and Russell 2000 have ranges to break, while the S&P continues to trade around its trendline.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.