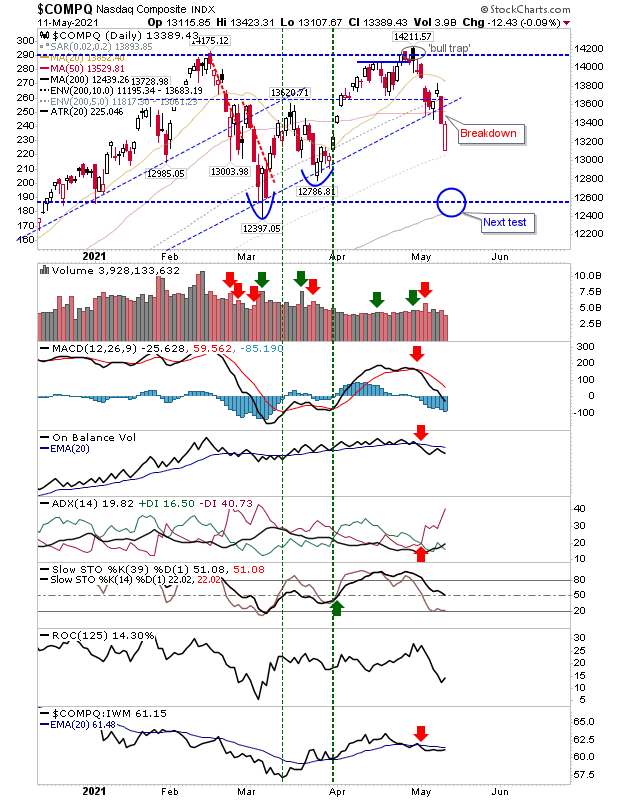

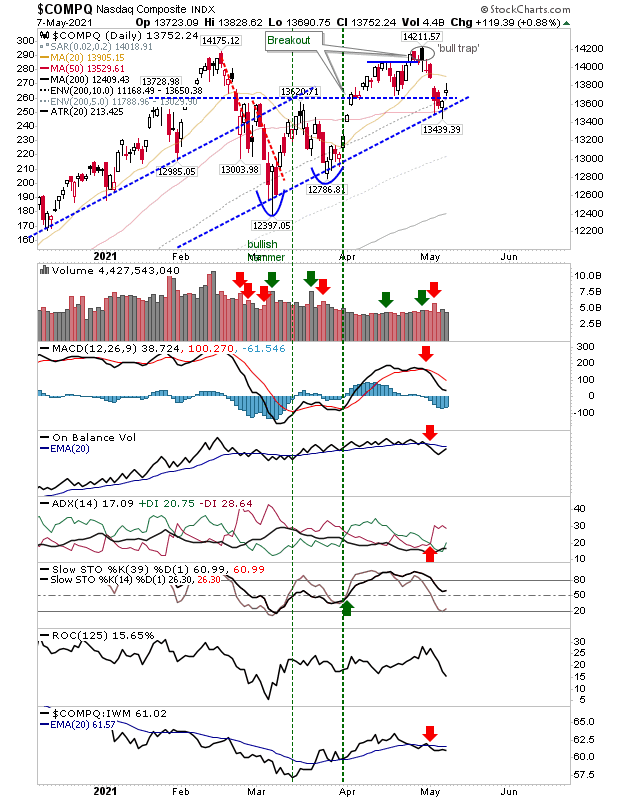

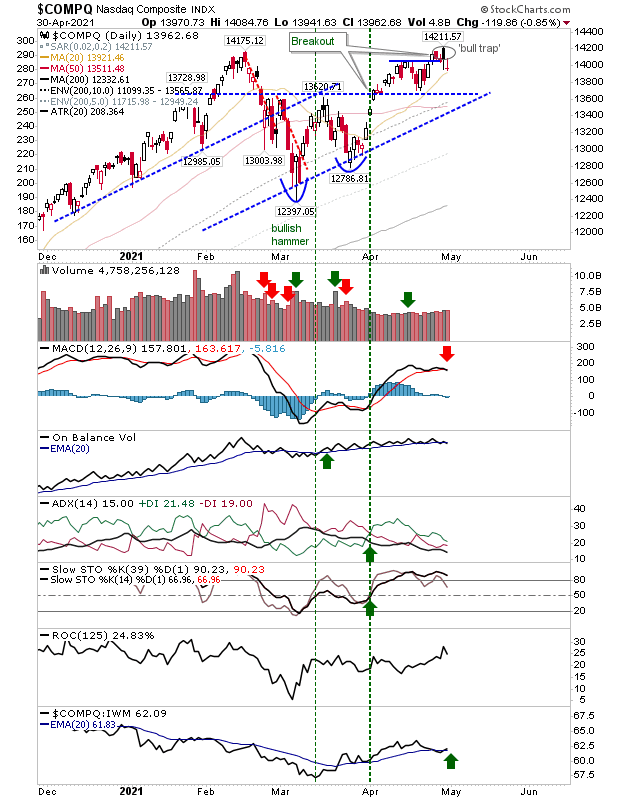

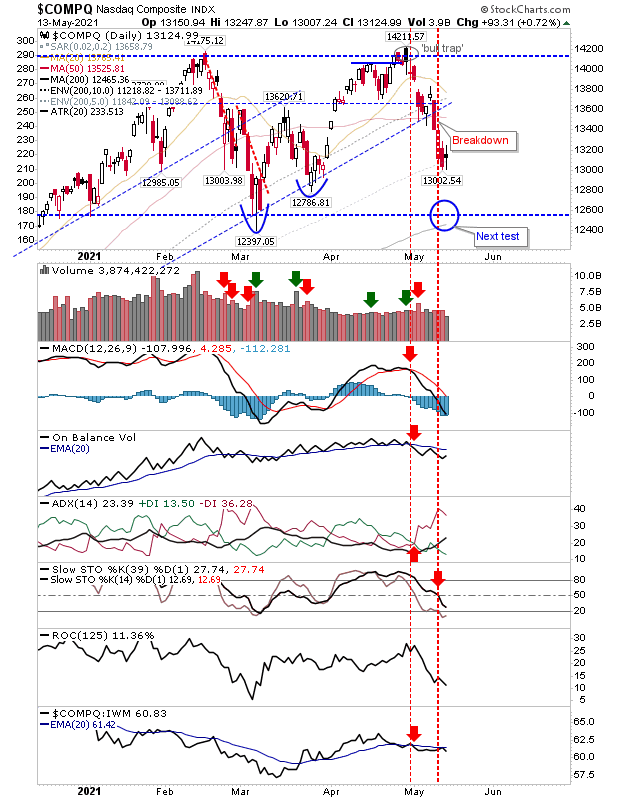

Weak Recovery Doesn't Offset Wednesday's Losses

The selling we have seen had much in common with that of February's, and because of that, what we are looking at is the development of trading ranges which will maintain a neutral outlook until there is a breach of March swing lows. The Nasdaq is perhaps the most vulnerable given prior strength, but it has started to underperform relative to the Russell 2000 as momentum moves into bearish territory but is not yet oversold.