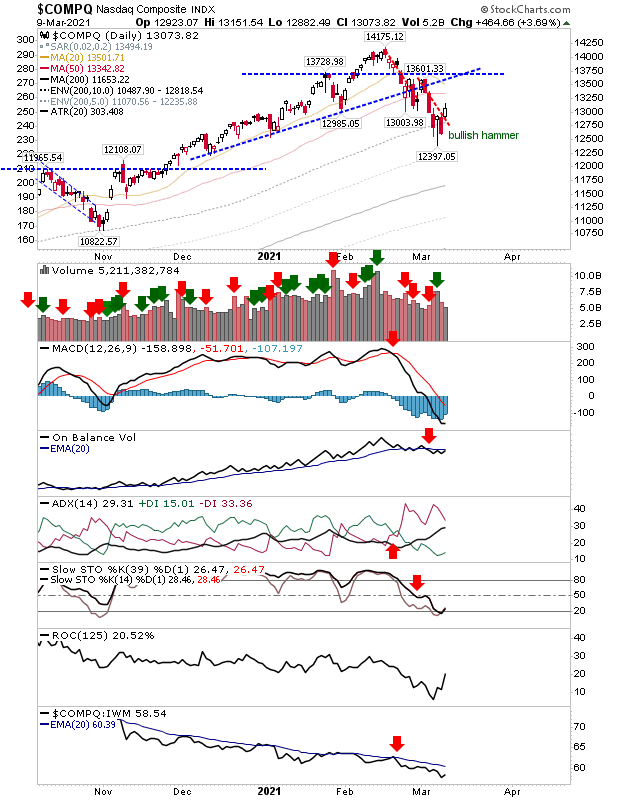

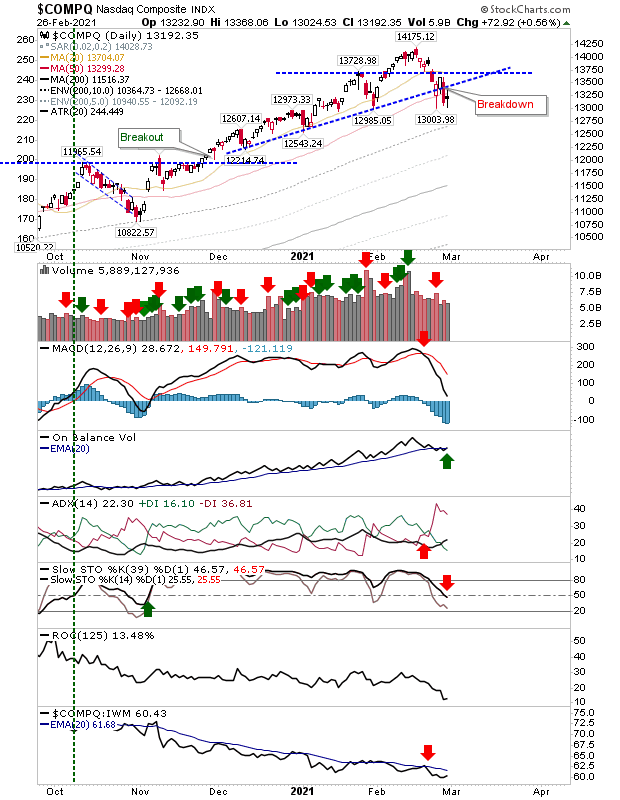

Indices have gone from new high breakouts, to 20-day MA tests, to breaks of trendline support - weakening at each step along way. The Nasdaq finished Friday with a loss of the 50-day MA after trendline support gave way on Thursday. Friday's volume was relatively light, but there was confirmed distribution on Thursday's selling. Technicals have taken a marked step lower, especially the MACD - although On-Balance-Volume is hanging on to its 'buy' signal. Intermediate stochastics [39,1] just undercut its mid-line, although a rally tomorrow would be enough to see this as the start of support for a secular trend pullback (although such a pattern would take time).