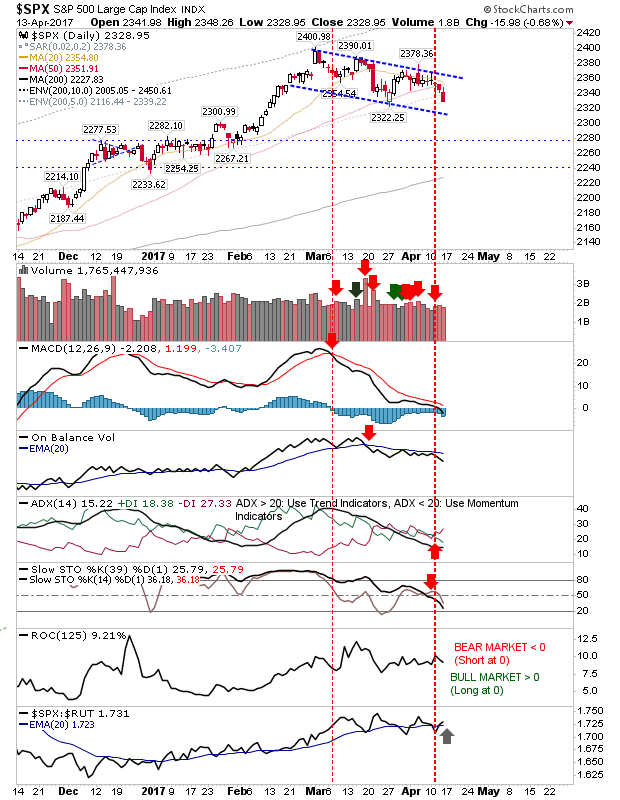

It has been a while since markets were net bearish, but the S&P, Nasdaq, Nasdaq 100, Dow Jones Industrials and Russell 2000 are all now net bearish in technical strength. Adding to this is a number of these indices have also broken from support channels. The best case for bulls is that markets shift sideways and work out the bearish technicals - building for the next rally. But if there is an acceleration down it could snowball in a manner similar to how markets rallied after the election. It's not a time to buy, and it may not be a bad time to sell or short. Long-term investors will probably stick as there is no way of knowing what may come - and an extended period of weakness is due which shouldn't worry investors (the March 2009 low I still view as a generational low). The S&P wasn't the biggest loser on Friday and this was reflected in the relative improvement of the index to its peers. The downward channel could still play as a 'bull flag', but if th...