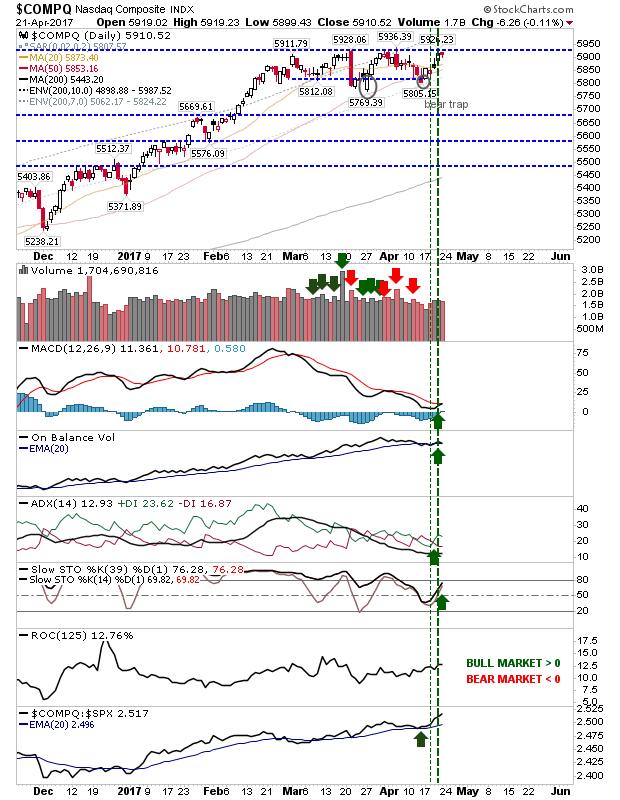

Things looking good for the Nasdaq as technicals return net bullish after a brief period of bearishness. This coincided with the index nestled against resistance helped by Friday's tight intraday action. The index is nicely placed for a breakout on Monday, especially given the relative out-performance of the Nasdaq against its peers.

As with the Nasdaq, the Nasdaq 100 also sits on the verge of a breakout, but unlike the aforementioned index its technicals are not yet net bullish.

The S&P lost a little ground on Friday, but it remains within a downward channel which has the characteristics of a 'bull flag'. While all technicals are still 'net bearish', the MACD is very close to a new 'buy' signal. An upside break would also take out the 50-day MA. However, with the relative performance of the index taking a nosedive against Small Caps and Tech indices, the easier option may be to take a short trade with a stop above the 50-day MA.

The Russell 2000 is morphing from a potentially bearish ascending triangle to a bullish 'bull flag'. Action from Thursday and Friday looks like a breakout of the 'bull flag'. Technicals have also turned net bullish with relative performance improving against the Nasdaq. The safest risk:reward is for longs to trade using a stop on a loss of 1,340; a stop on a loss of Friday's low would have a high risk for whipsaw but is an alternative play for those seeking a tighter risk:reward.

For Monday, longs have the better opportunities with the Nasdaq, Nasdaq 100 and Russell 2000. However, if there is a weak start or markets fade after the opening half hour, then the S&P could offer itself as a quick return short play (down to channel support).

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.