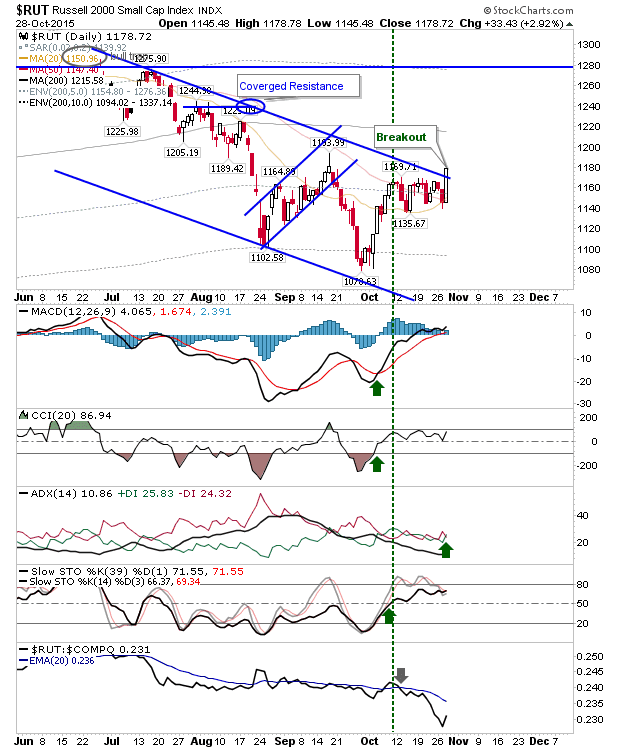

Small Caps Experience Selling

There wasn't a whole lot of action in markets after yesterday's decent gains. The only index to suffer any kind of reversal was the Russell 2000. It holds on to its channel breakout, but the 1% loss will have hurt it.