Daily Market Commentary: Consolidation

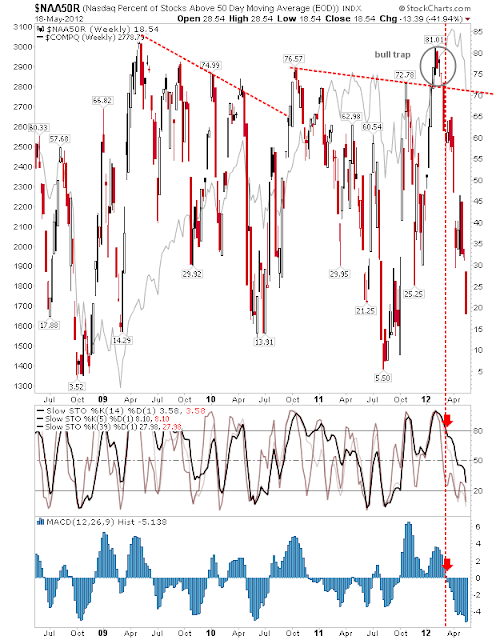

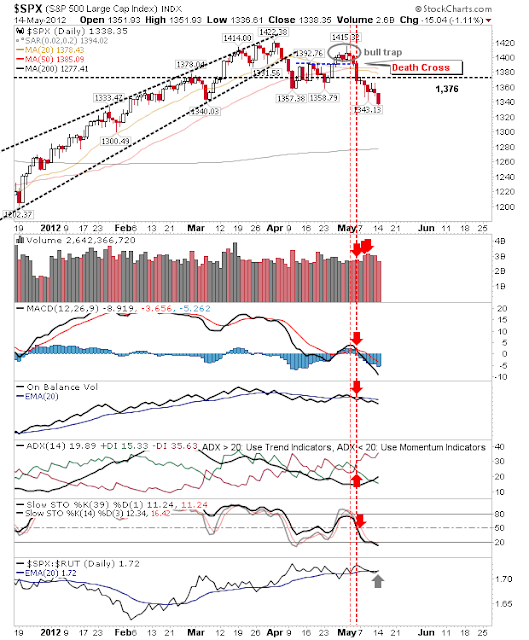

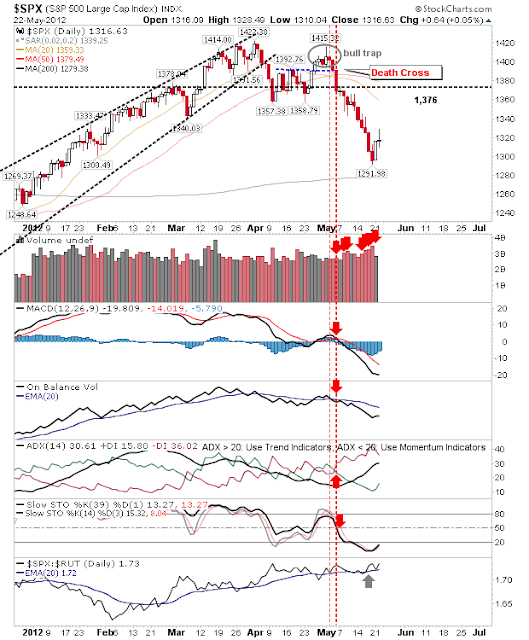

Has the momentum been knocked out of the bounce already? The losses were attributed to " weakness in Material and Energy " sectors, but these sectors were already on the ropes going into today. In my estimate, Materials are closer to a bottom than any other sector. The S&P closed flat after managing decent gains intraday, but trading volume was relatively light so it's a mixed bag as to whether the late day drop will be something to worry about. Technicals aren't even indicating a bullish divergence and the 200-day MA wasn't tested. The Nasdaq closed slightly down on yesterday, but it hadn't achieved the same degree of intraday gains as the S&P so its loss wasn't as great. Volume wasn't much different to yesterday. And like the S&P the technical picture is lacking the bullish divergence which might indicate a swing low. Of greater help to the Nasdaq are the more pronounced bullish divergences in Nasdaq breadth indices like th...