Weekly Market Commentary: Russell 2000 Support Test

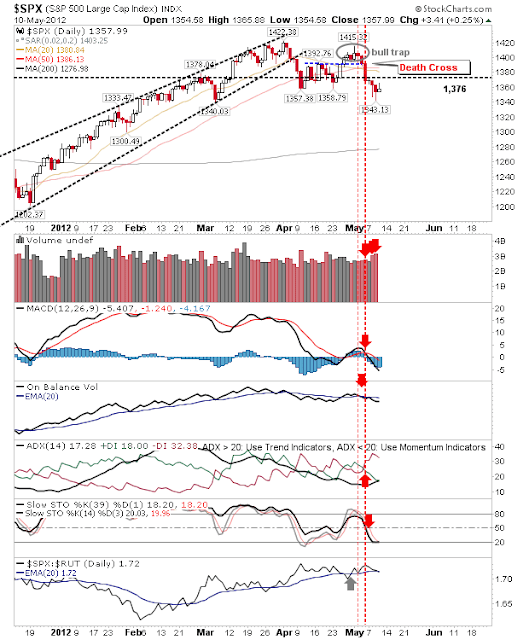

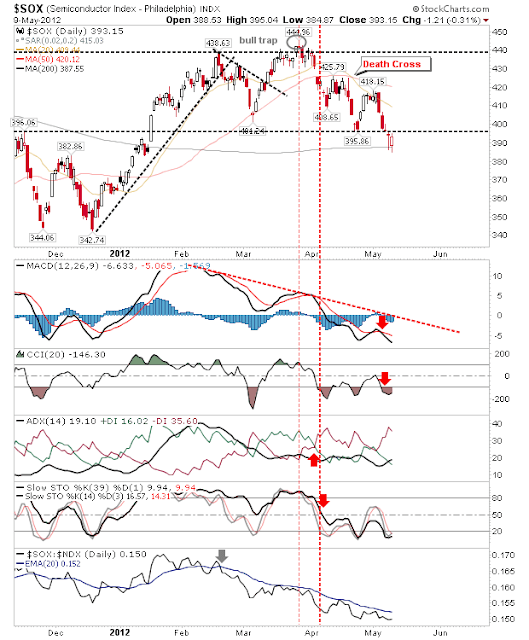

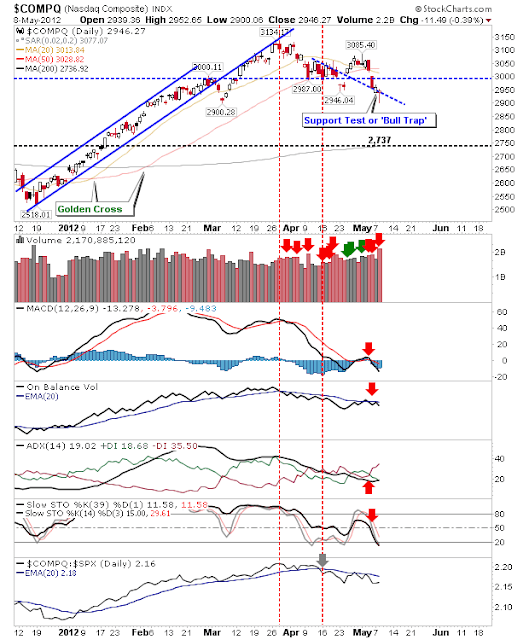

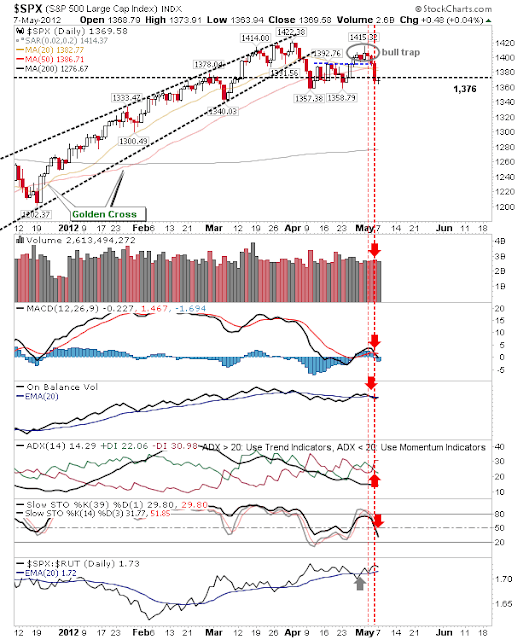

Markets finished the week scrambling for a bottom; some are in better shape than others but it may take further weakness in market breadth before that point is reached. The Percentage of Nasdaq Stocks above the 50-day MA finished the week at 32% but it had dropped into single digits last summer so a repeat can't be excluded - although most major swing lows occur between 15 and 30% (so the index is not far off a trading low) The Nasdaq Bullish Percents still have a way to go before they reach strong bottom territory. While the Nasdaq Summation Index is still in breakdown mode after dropping out of its rising channel. The parent Nasdaq is close enough to a major support level to offer itself as a 'buy' point. But there was also a MACD trigger 'sell' to balance against this. The Russell 2000 is the other index with the potential to be at a bottom. The index finished at converged support of the rising channel and the former neckline from early 20...