Markets were left in an interesting position by Friday's close. Ordinarily, I like to be a buyer when the S&P is at least 10% below its 200-day MA and

sector breadth is in the position it's in, but I think there is enough here to have me jump in on Monday's open and add to my long term positions. I suspect there will be a big one day gain to help establish the swing low. But I doubt it will be the absolute low for the current decline; at the same time, I don't want to be looking at a swing low with hindsight!

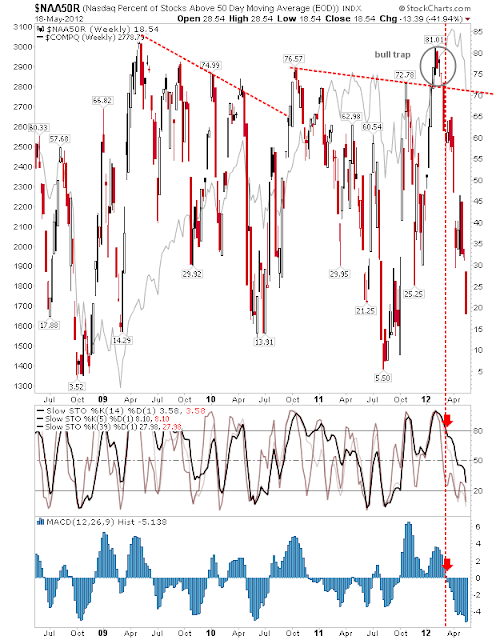

Market Breadth is in swing low territory. The Percentage of Nasdaq Stocks above 50-day MA dropped sharply to 18% although stochastics for this breadth indicator have not yet reached oversold territory. Although the MACD histogram reached a new multi-year low - lower than the 2008 low.

The Nasdaq Summation Index has some way to go before turning oversold based on stochastics, although the Index is close to a swing low based on past occurrences.

The Nasdaq Bullish Percents is the only market breadth indicator which hasn't yet reached swing low territory. Also, supporting stochastics only recently dropped out of overbought territory.

Last week's losses left the 2012 Nasdaq rally high-and-dry. The decline is on course to test the broadening wedge with support around 2,600 (but rising).

The Russell 2000 broke the rising channel line and 760 support - a double whammy for the index. However, I think it more likely a large trading range bound by 625 support and 850 resistance will emerge from this decline; part of a consolidation of the rally from March 2009.

Finally, the S&P edged outside of its rising channel in a probable breakdown, but more worryingly, there was a 'bull trap' to the 1,370 breakout.

Markets are in swing low form, but likely are not in the ultimate swing low for the decline.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!