Has the momentum been knocked out of the bounce already? The losses were attributed to "

weakness in Material and Energy" sectors, but these sectors were already on the ropes going into today. In my estimate, Materials are closer to a bottom than any other sector.

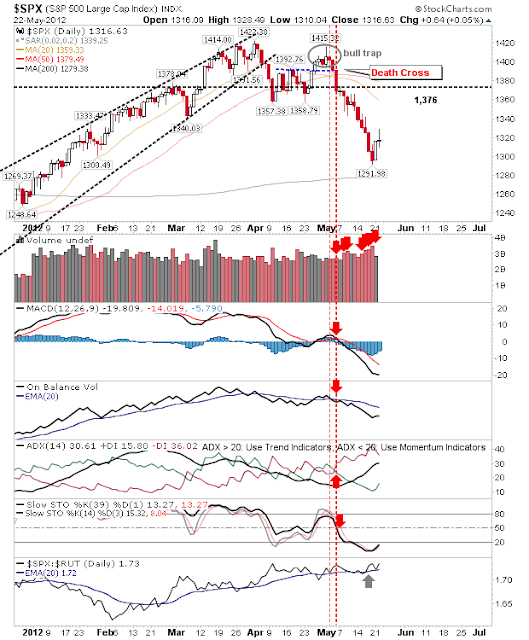

The S&P closed flat after managing decent gains intraday, but trading volume was relatively light so it's a mixed bag as to whether the late day drop will be something to worry about. Technicals aren't even indicating a bullish divergence and the 200-day MA wasn't tested.

The Nasdaq closed slightly down on yesterday, but it hadn't achieved the same degree of intraday gains as the S&P so its loss wasn't as great. Volume wasn't much different to yesterday. And like the S&P the technical picture is lacking the bullish divergence which might indicate a swing low.

Of greater help to the Nasdaq are the more pronounced bullish divergences in Nasdaq breadth indices like the Percentage of Nasdaq Stocks Above the 50-day MA. There are clear bullish divergence in the MACD histogram and CCI.

Although the Russell 2000 was pegged by past resistance which re-emerged to haunt the index although the 200-day MA held as support.

The semiconductor index didn't emerge outside of yesterday's range which probably helps it if you are a bull. Friday's low is the stop level for those looking to play (what still looks) a trade-worthy bounce to the 200-day MA.

Tomorrow could see another push lower to test the firmness of Monday's recovery; it may even break the low intraday but I suspect buyers will step in the afternoon as many sectors are heavily oversold.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!