Nasdaq manages to stage a breakout

After a volatile few days, indices have managed to stage a recovery with some indices doing better than others.

The Nasdaq managed to return above support, while breaking resistance from what had been a 'bull flag'. Volume eased back despite the gain; not a great association given the extent of today's move higher. Play the resistance breakout, but we don't want to see an undercut of 11,500 support.

The S&P is trapped inside its prior trading range having dropped below breakout support. Today's gain brought the index above its 200-day MA, but with the index back inside its prior consolidation it's not exactly clear as to what can be expected next.

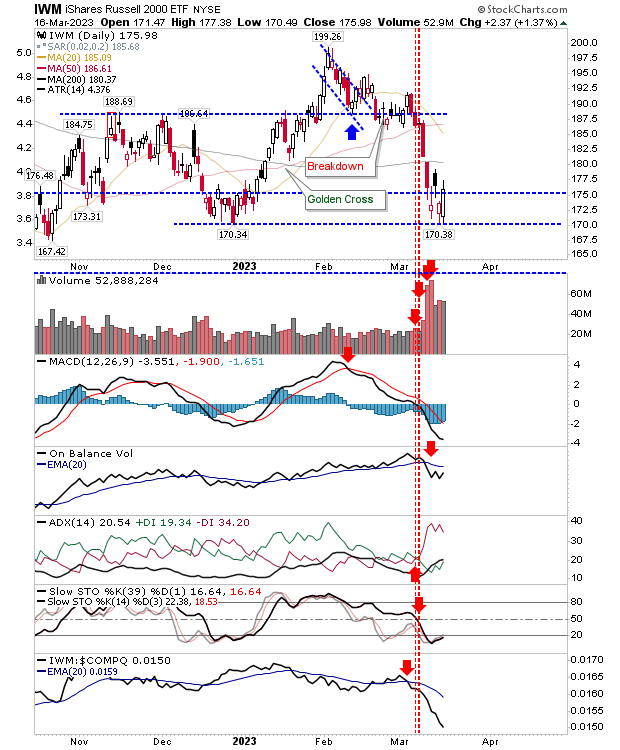

The Russell 2000 had give up the most ground from the indices; from holding breakout support to a quick return to Christmas lows it has had most traumatic week. Today's action ranked as a sizable bullish engulfing pattern on oversold momentum - a bullish sign. Look for some upside follow through tomorrow although I suspect the 200-day MA could prove itself to be problematic for bulls.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.