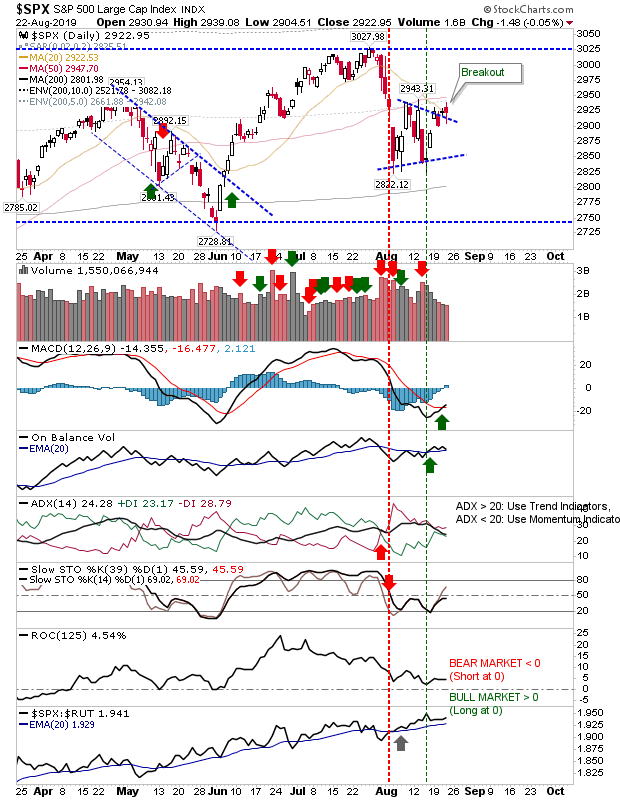

The past week saw lots of big one-day changes, but from the context of where indices lie there was little to say other than it generated a whole tonne of noise. For the S&P, daily swings were contained by the lead moving averages (20-, 50-day above and 200-day below). Again, the key price zones to determine if we will have a new bear market or continuation bull market are 3,025 and 2,750. Technicals reflected this mess with a new 'buy' signal in On-Balance-Volume while the MACD remains firmly bearish as stochastics [39,1] and [14,3] converge in oversold territory. The index has accelerated its relative performance against the Russell 2000, suggesting that when money move into the market it's doing so in favour of Large Cap stocks (not a ringing endorsement for the secular bull rally to continue).