Markets Poised Heading Into Next Week

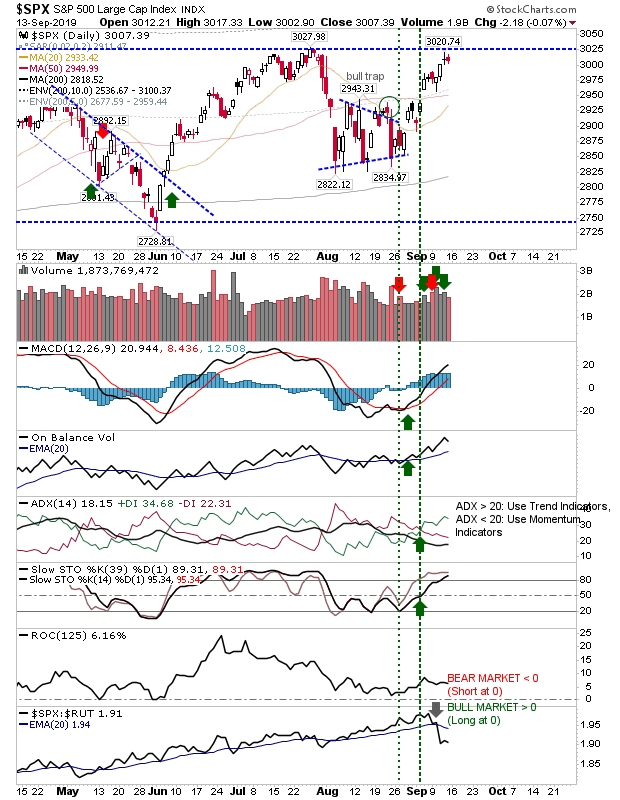

While Small Caps stole the show last week it may be the time for Large Caps to step up to the plate. Leading the charge is the S&P. The index is sitting just below resistance after ending the week just shy of a break of 3,025. Technicals are net bullish, which should help. Despite two sequential doji, volume was lower on the down day, which is bullish.

The Nasdaq is caught in the middle with room to maneuver to resistance. It won't breakout before Large Caps so it won't gather the headlines, but the basis is there for the index to benefit from a move higher.

Helping it will be the Semiconductor Index. It's working to negate the 'bull trap' from July but when it eventually does, it will help fuel the rally in the Nasdaq and Nasdaq 100.

Not surprisingly, the Russell 2000 is taking a bit of a breather after it's big gain on Thursday. It's toying with the July swing high (which is not it's all-time high), but getting past this will open up the larger challenge of all-time highs, while the July high will offer a future a support level. Again, Large Caps are probably going to do the heavy lifting first before attention swings to Small Caps

For next week, it will be about looking for a lead out breakout in Large Caps, followed by the Nasdaq and then Small Caps. But first, the S&P and Dow Jones Industrial Average have a job to do.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Nasdaq is caught in the middle with room to maneuver to resistance. It won't breakout before Large Caps so it won't gather the headlines, but the basis is there for the index to benefit from a move higher.

Helping it will be the Semiconductor Index. It's working to negate the 'bull trap' from July but when it eventually does, it will help fuel the rally in the Nasdaq and Nasdaq 100.

Not surprisingly, the Russell 2000 is taking a bit of a breather after it's big gain on Thursday. It's toying with the July swing high (which is not it's all-time high), but getting past this will open up the larger challenge of all-time highs, while the July high will offer a future a support level. Again, Large Caps are probably going to do the heavy lifting first before attention swings to Small Caps

For next week, it will be about looking for a lead out breakout in Large Caps, followed by the Nasdaq and then Small Caps. But first, the S&P and Dow Jones Industrial Average have a job to do.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.