Triple Witching Skews Selling Volume

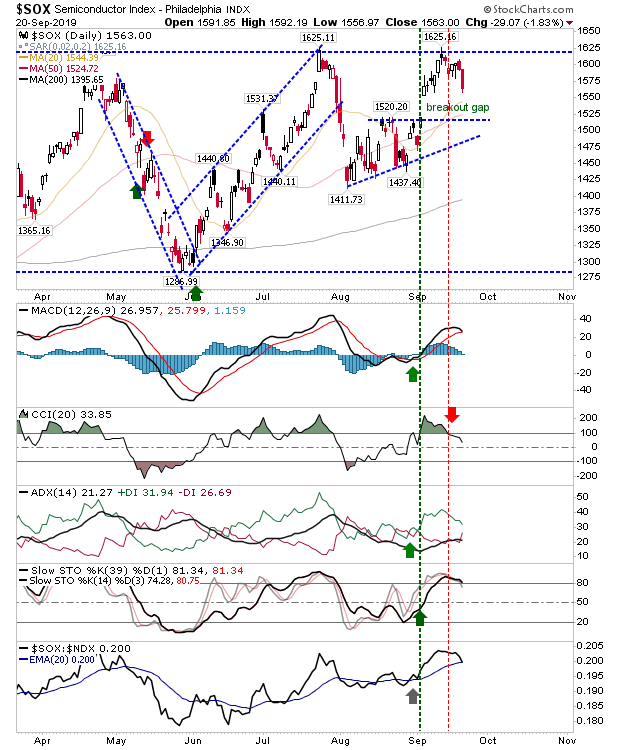

Friday's witching volume came with resistance selling, but the extent of the damage remains to be seen for most indices as range trading remains satisfied. Biggest damage was done to the Semiconductor Index as the challenge of the 'bull' trap failed, broadening range resistance to 1,625. It could be another few weeks before we talking breakout here.

The loss in the Nasdaq kept the index within the trading range of the last couple of weeks. With major resistance at 8,340, and converged support of 20-day and 50-day MAs around 8,060, anything else between is just noise, and Friday was no exception.The only real concern is the distribution trend in On-Balance-Volume which has been running lower since the start of August.

The S&P is trading inside a mini-range from the past week, but remains very close to a major breakout of 3,025 resistance; should this happen it would mark the first of the lead indices to make new all-time highs. While relative performance is negative, other technicals are net bullish. This is the index to watch.

The Russell 2000 performed as one of the best indices on the day. The 'spinning top' from Friday is a neutral candle and given the aggregation near the high of the prior rally it's looking like there is more to come. Major resistance remains at 1,610 and the index remains a long way from challenging it.

For Monday, investors will want to see the S&P break over the first part of the week, but it's possible the Russell 2000 could surprise and leap frog above the S&P in leading indices on the next phase of the secular rally. Overall, indices do look primed for higher prices after sellers failed to break bullish resolve in August when trading range support held.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The loss in the Nasdaq kept the index within the trading range of the last couple of weeks. With major resistance at 8,340, and converged support of 20-day and 50-day MAs around 8,060, anything else between is just noise, and Friday was no exception.The only real concern is the distribution trend in On-Balance-Volume which has been running lower since the start of August.

The S&P is trading inside a mini-range from the past week, but remains very close to a major breakout of 3,025 resistance; should this happen it would mark the first of the lead indices to make new all-time highs. While relative performance is negative, other technicals are net bullish. This is the index to watch.

The Russell 2000 performed as one of the best indices on the day. The 'spinning top' from Friday is a neutral candle and given the aggregation near the high of the prior rally it's looking like there is more to come. Major resistance remains at 1,610 and the index remains a long way from challenging it.

For Monday, investors will want to see the S&P break over the first part of the week, but it's possible the Russell 2000 could surprise and leap frog above the S&P in leading indices on the next phase of the secular rally. Overall, indices do look primed for higher prices after sellers failed to break bullish resolve in August when trading range support held.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.