Small Caps Feels The Heat

It was a generally quiet day for markets with Small Caps feeling most of the pressure.

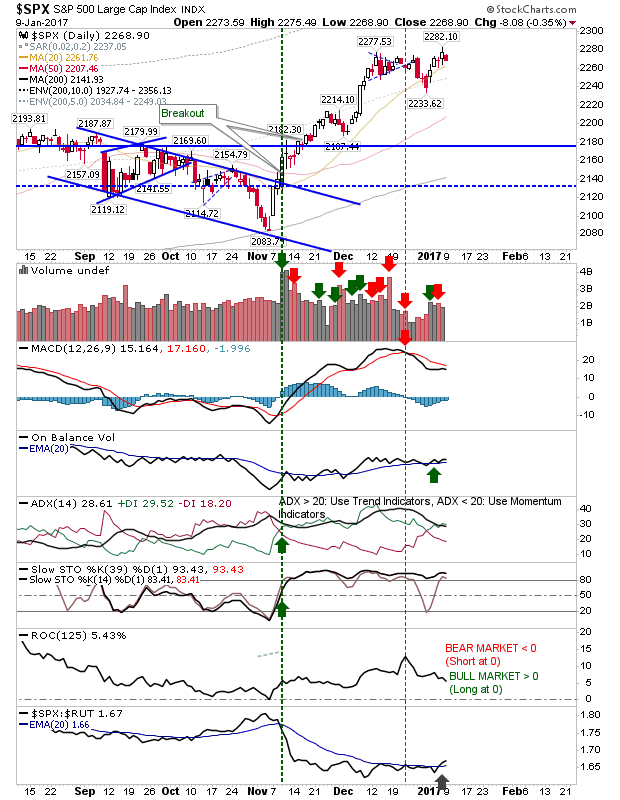

The S&P took a quarter percentage loss as it gave back a small amount of last week's gain. There was no technical change on this loss. Nothing to be too concerned about.

The Nasdaq managed to post a small gain which helped boost the technical picture of the index. Key to this index (and the Nasdaq 100) is holding on to the breakout. Today's action kept this breakout intact and returned a MACD trigger 'buy'.

The Russell 2000 is the index most feeling the squeeze. The consolidation breakout is under threat of becoming a 'bull trap' before the Nasdaq. Any loss tomorrow will likely confirm as such.

For tomorrow it will be again be watching for a Nasdaq 'bull trap', alongside a new candidate in the Russell 2000. The S&P could yet break higher despite this, and it would appear critical to do so if the Russell 2000 is to pull back from the brink.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P took a quarter percentage loss as it gave back a small amount of last week's gain. There was no technical change on this loss. Nothing to be too concerned about.

The Nasdaq managed to post a small gain which helped boost the technical picture of the index. Key to this index (and the Nasdaq 100) is holding on to the breakout. Today's action kept this breakout intact and returned a MACD trigger 'buy'.

The Russell 2000 is the index most feeling the squeeze. The consolidation breakout is under threat of becoming a 'bull trap' before the Nasdaq. Any loss tomorrow will likely confirm as such.

For tomorrow it will be again be watching for a Nasdaq 'bull trap', alongside a new candidate in the Russell 2000. The S&P could yet break higher despite this, and it would appear critical to do so if the Russell 2000 is to pull back from the brink.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.