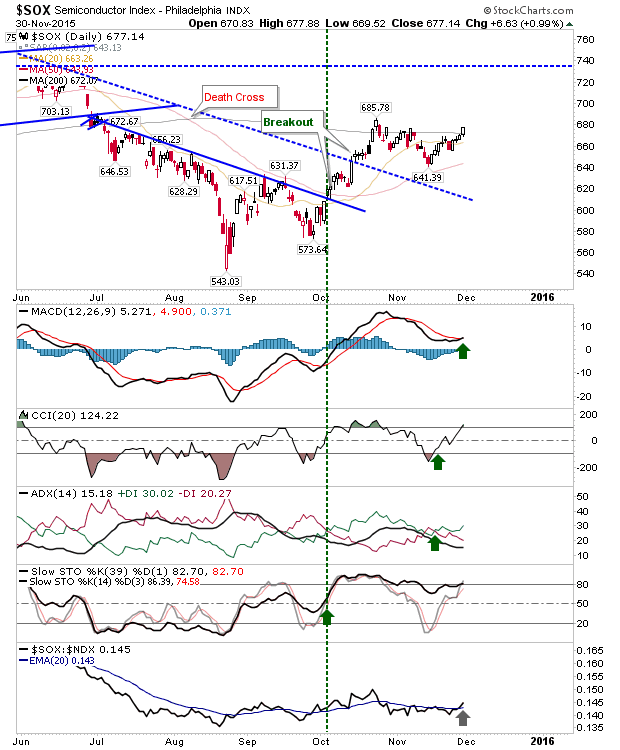

Semiconductor Index Breaks 200-day MA

Today offered a heavier than expected volume day post-holiday. The majority of this action was to the downside, but the Semiconductor Index bucked the trend. The latter index was able to push above its 200-day MA as it posted a relative advantage against the Nasdaq 100. While the Nasdaq and Nasdaq 100 suffered losses today, both will be helped by strength in the Semiconductor Index. All technicals for the Semiconductor Index are in the green, with a return of the MACD to a 'buy' trigger (above the bullish zero line - a bullish development).