Day of Rest

After all the ups and downs, today was relatively calm. The picture from yesterday is more or less unchanged.

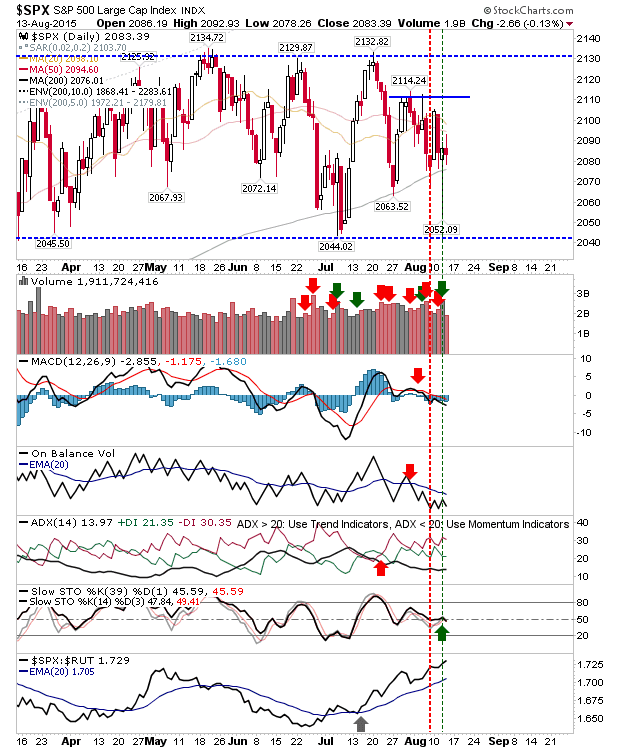

The S&P is holding on to its 200-day MA, but given neutral action today and the proximity of the index to this moving average, it was a little disappointing. An undercut and weak finish Friday would set a more bearish tone for next week.

The Nasdaq continues to anchor itself around 5,038, although today's trading volume was well below yesterday's. Lots of room for maneuver for both sides to play tomorrow.

The Russell 2000 experienced a small loss, but there is whole lot riding on Thursday's 'hammer' spike low holding. Bulls will not want to see a Friday close inside Thursday's lower spike (or even lower...)

The Semiconductor Index is the one to keep an eye on. It continues to shape a bullish wedge as action narrows towards a wedge apex.

Tomorrow will be about defending Thursday's late day surge. Can markets hold yesterday's gains into next week?

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is holding on to its 200-day MA, but given neutral action today and the proximity of the index to this moving average, it was a little disappointing. An undercut and weak finish Friday would set a more bearish tone for next week.

The Nasdaq continues to anchor itself around 5,038, although today's trading volume was well below yesterday's. Lots of room for maneuver for both sides to play tomorrow.

The Russell 2000 experienced a small loss, but there is whole lot riding on Thursday's 'hammer' spike low holding. Bulls will not want to see a Friday close inside Thursday's lower spike (or even lower...)

The Semiconductor Index is the one to keep an eye on. It continues to shape a bullish wedge as action narrows towards a wedge apex.

Tomorrow will be about defending Thursday's late day surge. Can markets hold yesterday's gains into next week?

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!