Weekly Market Commentary: Small Caps Breakout

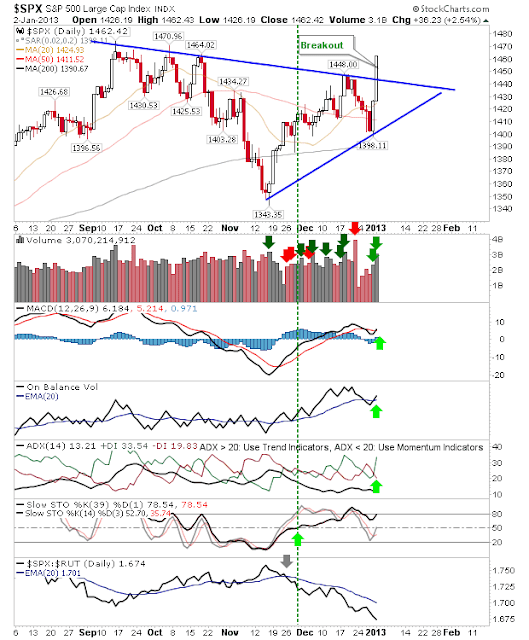

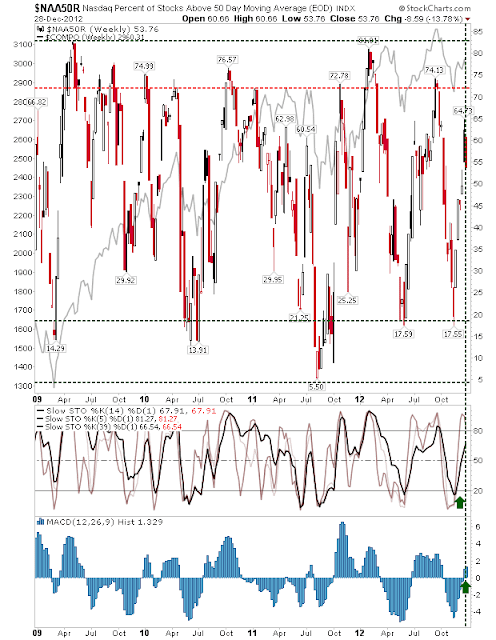

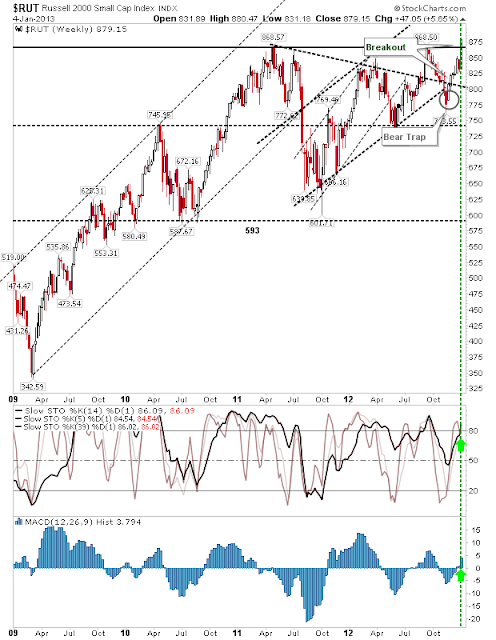

It was a good week for the indices, with the fiscal cliff nonsense resolving in bulls favor. The Russell 2000 was the star of the week as it made new multi-year highs. It handily cleared resistance on a net bullish turn in technicals. Bulls will want 868 to hold as end-of-week support if this is a valid breakout. The Percentage of Nasdaq Stocks above 50-day MA is in overbought territory, although this rarely signals an absolute top, it does suggest those looking to buy are best to wait for the next pull back. Technically, this breadth metric turned net bullish. The Nasdaq Bullish Percents also finished the week net bullish (in technicals). However, it is someway from overbought territory, which bodes well for a continuation of this rally (with the Percentage of Nasdaq Stocks above the 50-day MA marking a temporary swing high of a larger move). It was the same for the Nasdaq Summation Index, which is neither overbought directly, or technically. Again, this favors furthe