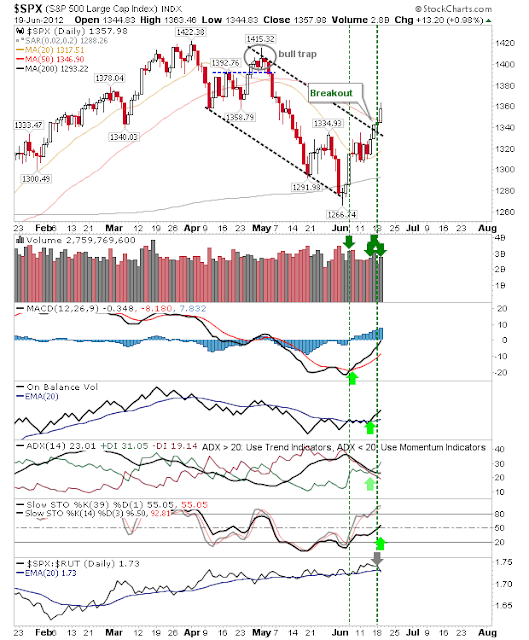

Today's buying came earlier than expected and helped solidify the bullish position.

The S&P finished above its 50-day MA on higher volume accumulation with a net bullish turn in technicals; a solid day for the index and gives some breathing room when sellers make their inevitable return. But there was also another pass made with a relative strength shift to Small Caps and away from Large Caps - nascent though this shift is.

This shift in relative strength was made apparent in the Russell 2000 after yesterday's disappointment. Buyers pushed the index through its 50-day MA, leaving it close to a resistance challenge.

The Nasdaq fell between the S&P and Russell 2000 with its modest 1% gain. It too was able to finish the day above its 50-day MA, but it was unable to finish the day with net bullish technicals. However it's well positioned to make additional gains.

The only spanner in the works for the Nasdaq is the lagging semiconductor index. In a mixed day there was a bearish 'Death Cross' between the 50-day and 200-day MA, but also a bullish channel breakout.

Given the significant hurdles cleared the past few days it would not be surprising to see indices consolidate their gains. It could be a quiet day tomorrow?

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!