It was an odd day for bulls. All the key indices enjoyed big gains, posting returns of over 2%, but there was very little buying of

speculative stocks with buyers preferring to focus on

financials like Bank of America and Morgan Stanley.

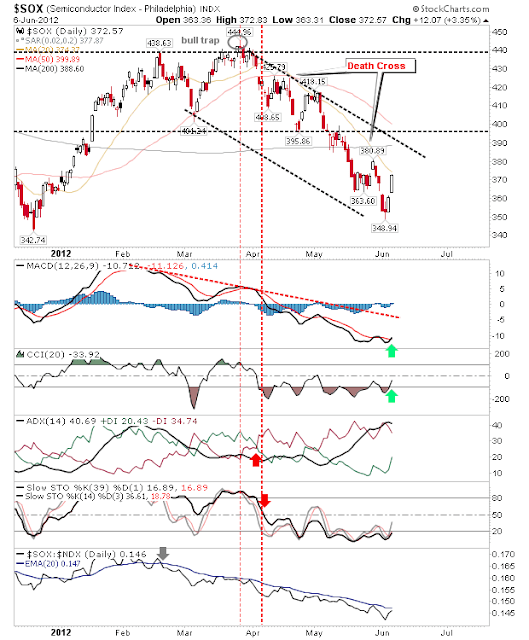

The biggest winner was the semiconductor index with its 3%+ gain. The index rallied right up to its 20-day MA and gained enough to see a MACD trigger 'buy'. There was a gain in relative strength against the Nasdaq, but not enough to see a net bullish shift towards semiconductor stocks. Watch for a consolidation around the 20-day MA before a secondary push to channel resistance.

The S&P also rallied to its 20-day MA with a bull cross in On-Balance-Volume, but not enough to see a bull cross in its MACD. There was also a relative shift loss to Small Caps (Russell 2000), which in itself is bullish for the market as a whole, even if it hurts the S&P.

The Russell 2000 had rallied back above its 200-day MA (and also to its 20-day MA) but stalled out at 764 resistance. Like the semiconductor index it had seen a bull cross in its MACD but it has more overhead resistance to consider.

The Nasdaq gapped and rallied to its 20-day MA, but was unable to break through as was the case for other indices. It did manage a MACD trigger 'buy' and enjoyed a relative shift gain to the S&P.

Given heavy volume buying there should be enough momentum to see rallies challenge channel resistance. However, the universal halt at 20-day MAs may offer a couple of days respite and therefore an opportunity for bulls who may have missed today's buying to get a second bite of the cherry.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!