Daily Market Commentary: Small Caps Defend 200-Day MA

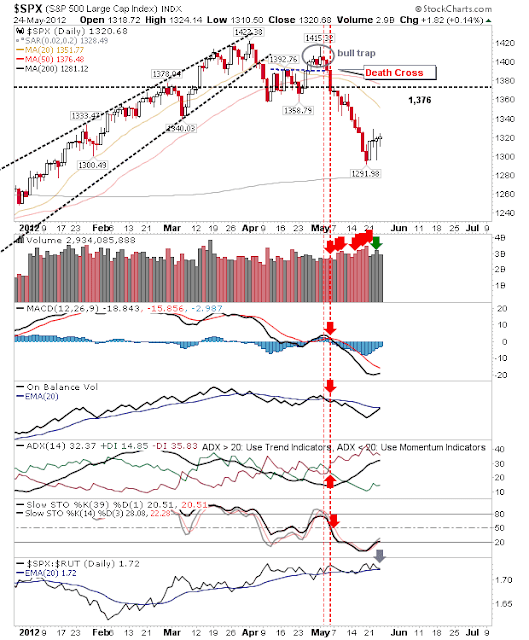

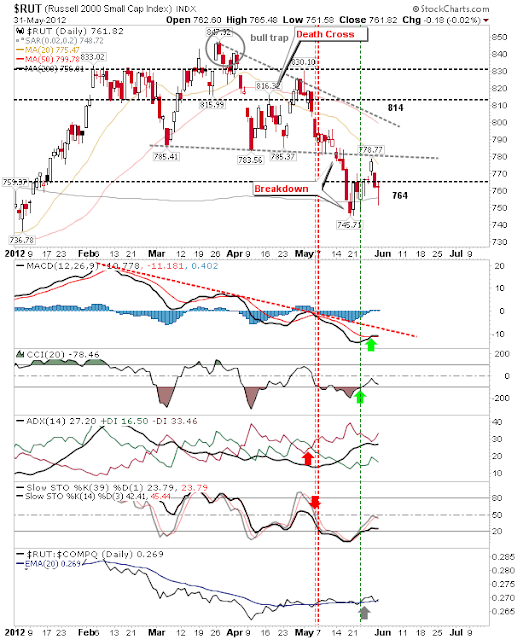

It was looking rough for the indices as Spain did its best to surpass Greece to be first in line to jump the Euro. Markets will need more than soothing words from the IMF to rescue this one but there was some reprieve in afternoon trading. The Russell 2000 was able to defend its 200-day MA as the 'buy' trigger in the MACD held on for another day along with the relative gain against the Nasdaq. A break above today's high sets up a long trade with a stop placed on the next duck below the 200-day MA. The S&P suffered another day of distribution but it finished in the middle of the days' range. The setup is not as bullish as it is for the Russell 2000, but Large Caps are holding a small edge over Small Caps which may make it a 'less' risky trade. The Nasdaq was able to finish near the day's highs, but it's caught between the Russell 2000 and S&P in terms of potential upside. The MACD 'buy' trigger is still in play. Bulls nee...