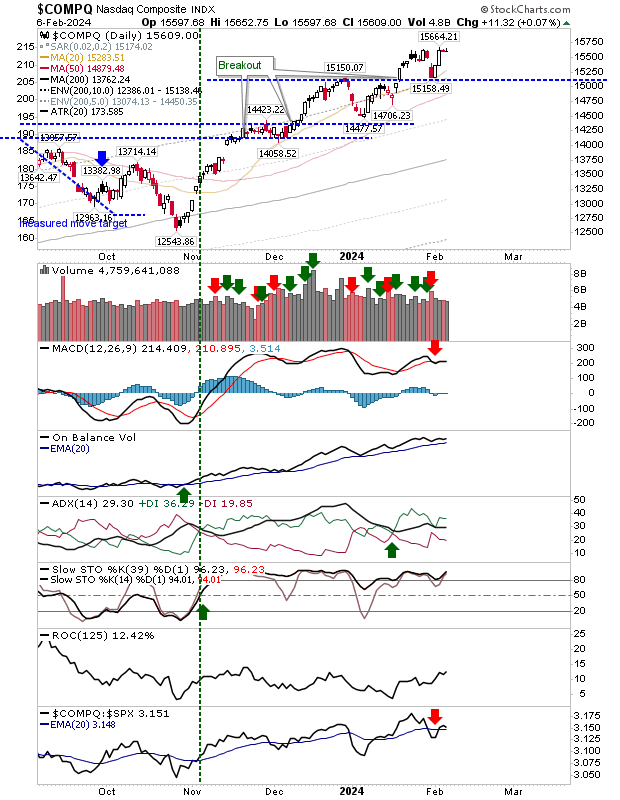

Breakdown gaps close for S&P an Nasdaq

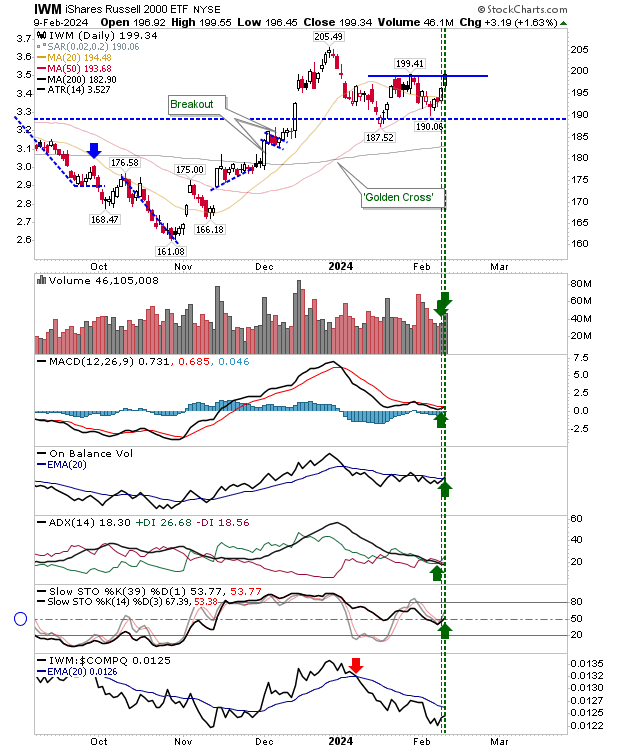

When the week started with breakdown gaps for the Nasdaq and S&P, it continued with moves to close said gaps, before peaking on Friday and reversing. Consequently, the likelihood of further losses heading into next week is quite high. If we see losses, then 50-day MAs are the likely test. Since 2024, both the S&P and Nasdaq have be holding 20-day MA support, but a fourth test of the latter moving average would likely be a step too far (for the moving average to hold as support). Adding to the selling pressure are MACD 'sell' triggers. And as a final point, the Nasdaq is underperforming relative to the S&P, suggesting that if there is an index to crack first, it will be the Nasdaq.