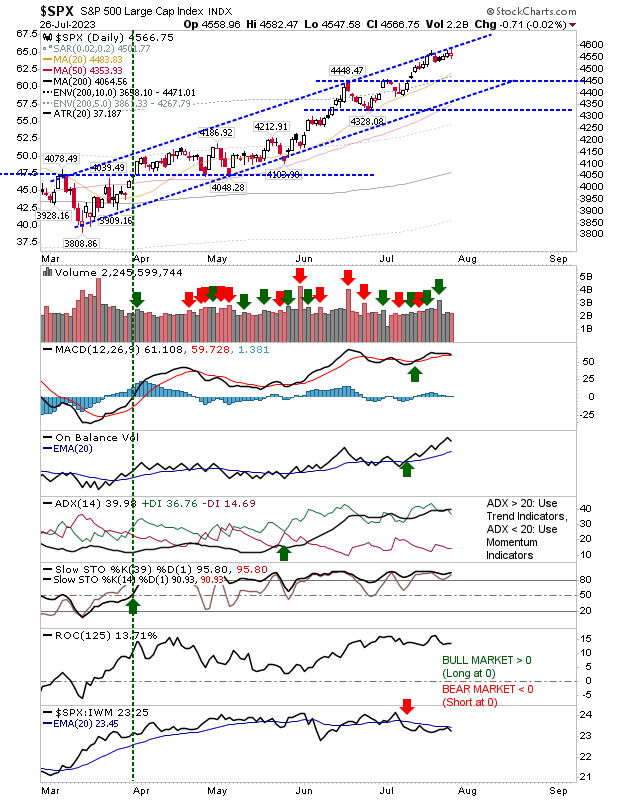

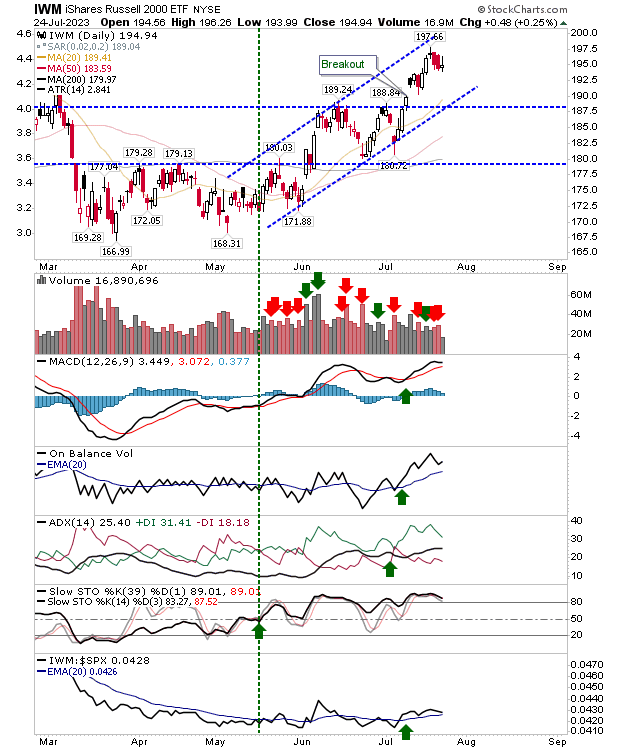

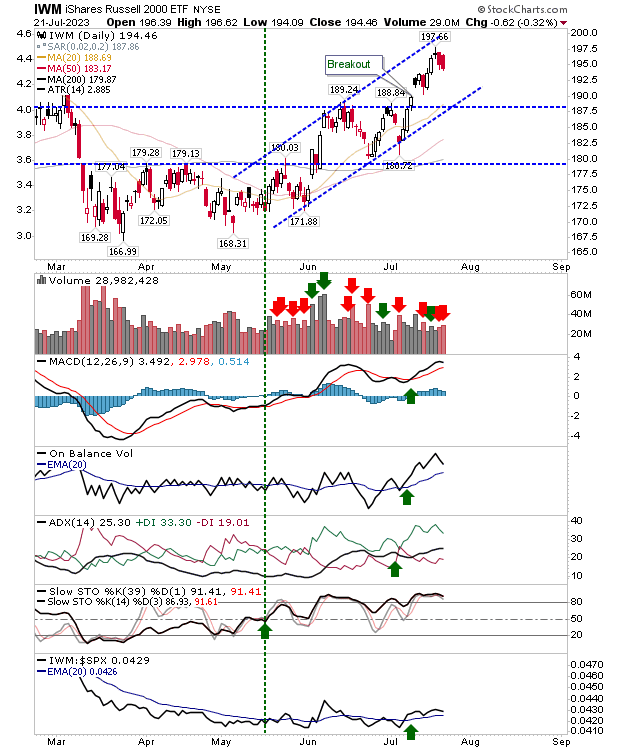

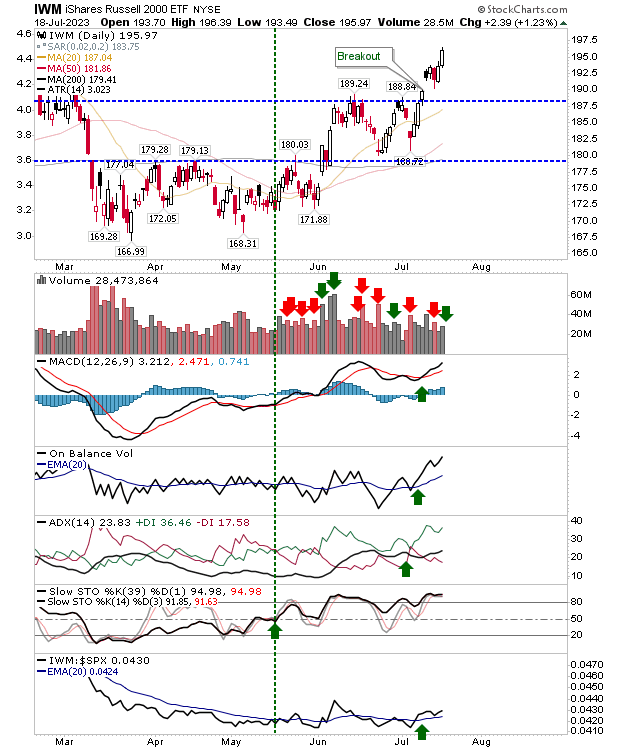

It was inevitable sellers would come in to pick at the breakout, and they did so with aplomb, but not before they left behind some bullish signs. Last Friday was not an options expiration day, so volume ranked as distribution, but no support level was challenged by the close of business. The biggest selling was found in the Russell 2000 ($IWM), but such action didn't reverse any of the bullish technical signals in the index. The Nasdaq and S&P experienced less selling than the Russell 2000, but the selling did rank as distirbution. Friday's action could be considered a doji, and the indecision asscoiated with this candlestick could mark a reversal, but neither the Nasdaq or S&P are at resistance - so I would view this as a pause in the rally. The S&P saw a new 'buy' trigger in the MACD, keeping lead technicals as net positive. The Nasdaq also delivered on a MACD 'buy' as it runs inside its rising channel. Technicals are in excellent s...