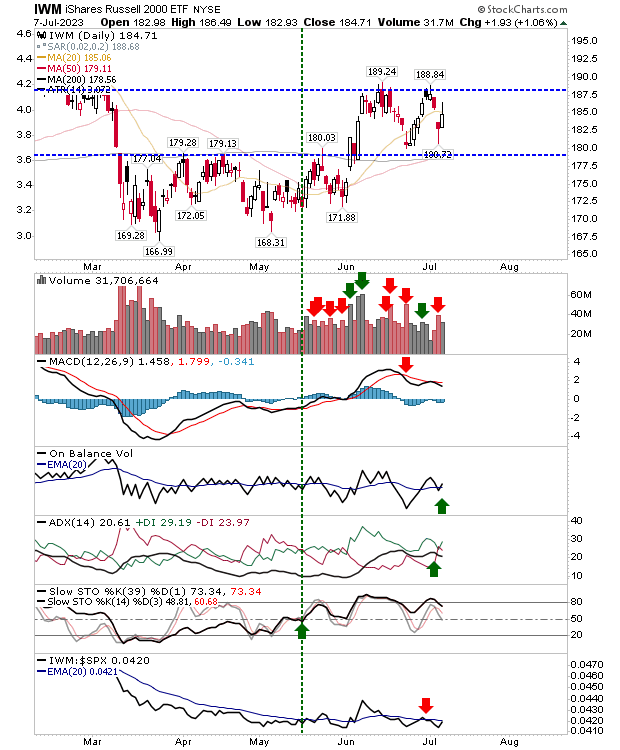

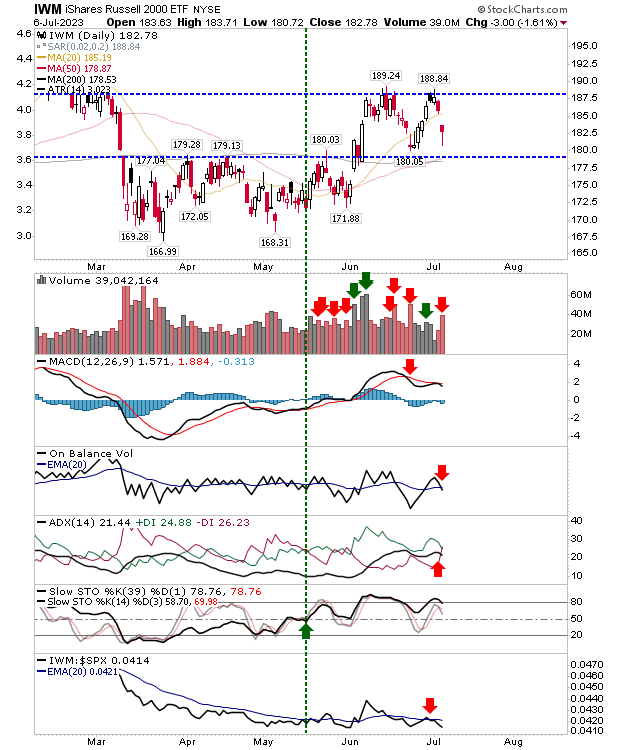

Russell 2000 breaks from base in (low) key move

It's holiday season and blog traffic is way down, but while people are away enjoying their vacation those traders left behind have decided to drive a break of resistance in the Russell 2000. There is no confirmed accumulation, but there was a new 'buy' trigger in the MACD and an outperformance relative to the S&P.