A tick in the calendar as today's non-event keeps markets on track for breakouts

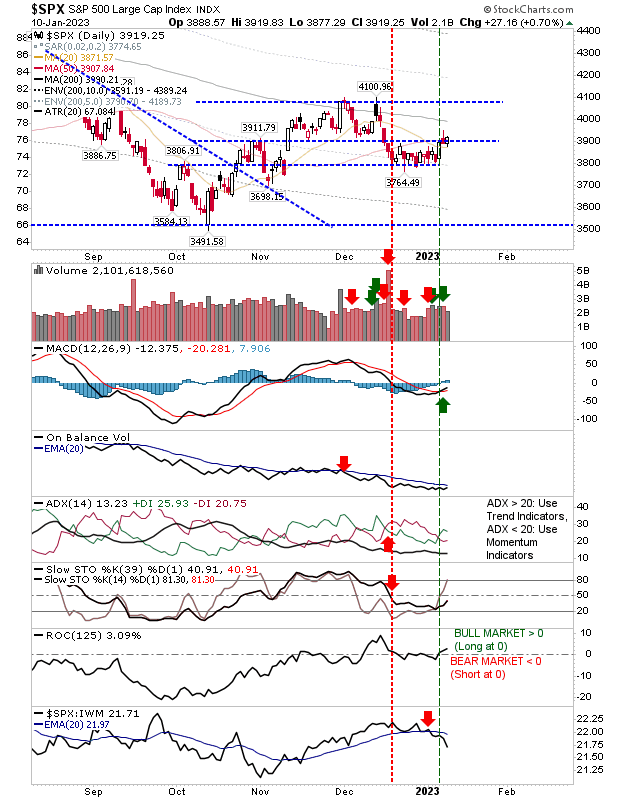

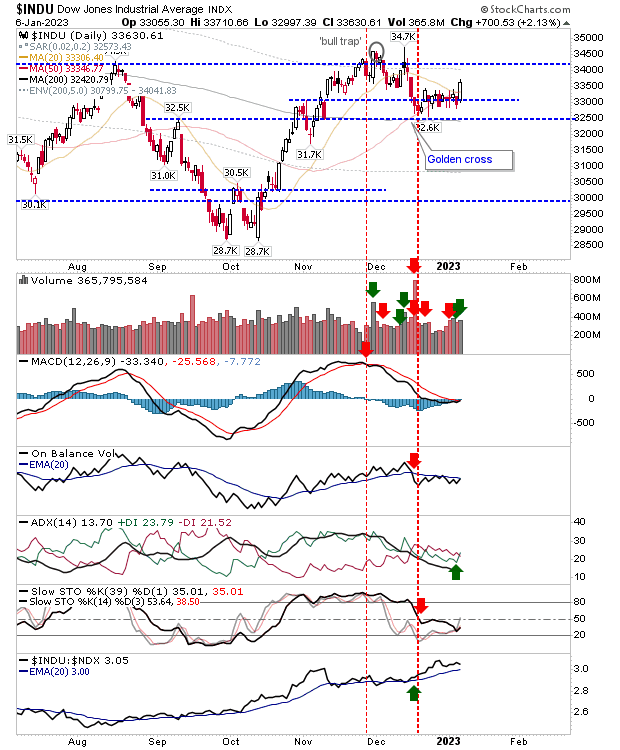

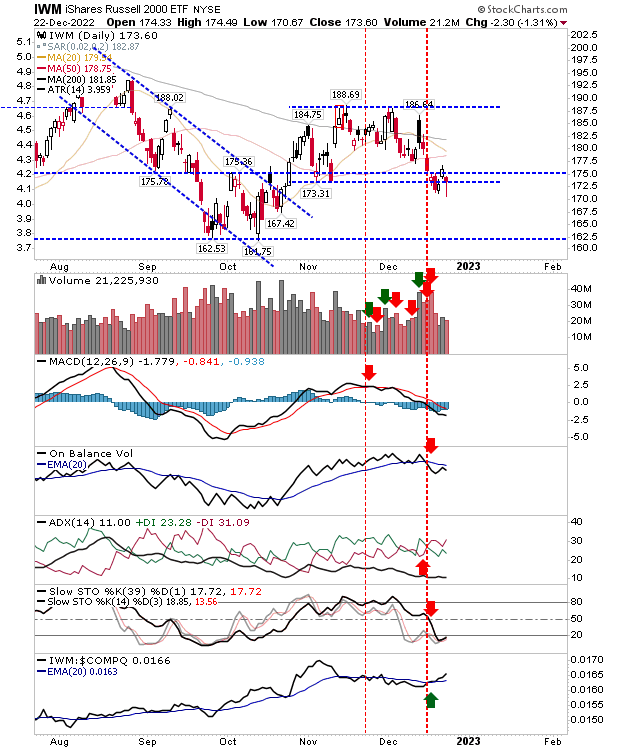

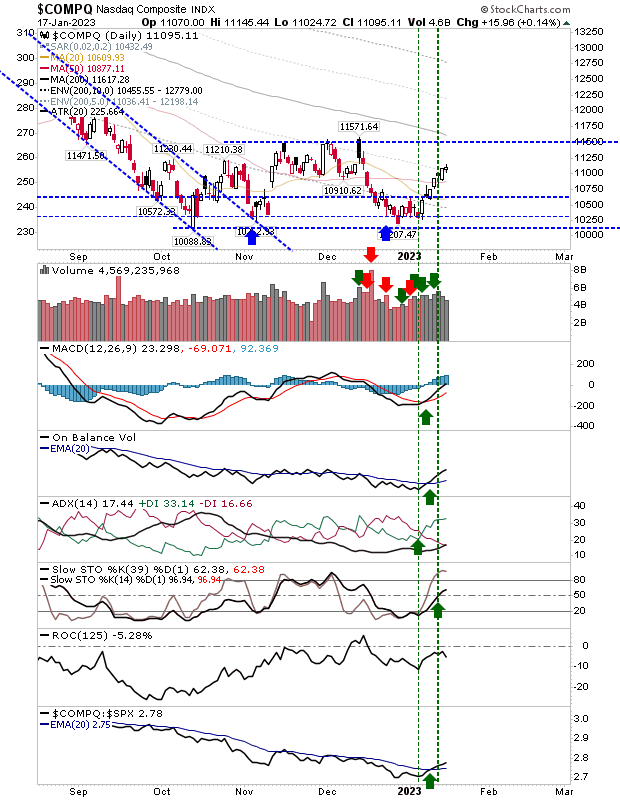

A pause in the Santa rally keeps things on track without confirming anything. The Nasdaq had the best of the action by virtue of its modest close higher, but really, there wasn't much in it for any of the indices. Volume was below Friday's, so no registered accumulation day, but it did at least add to the bullish trend in On-Balance-Volume.