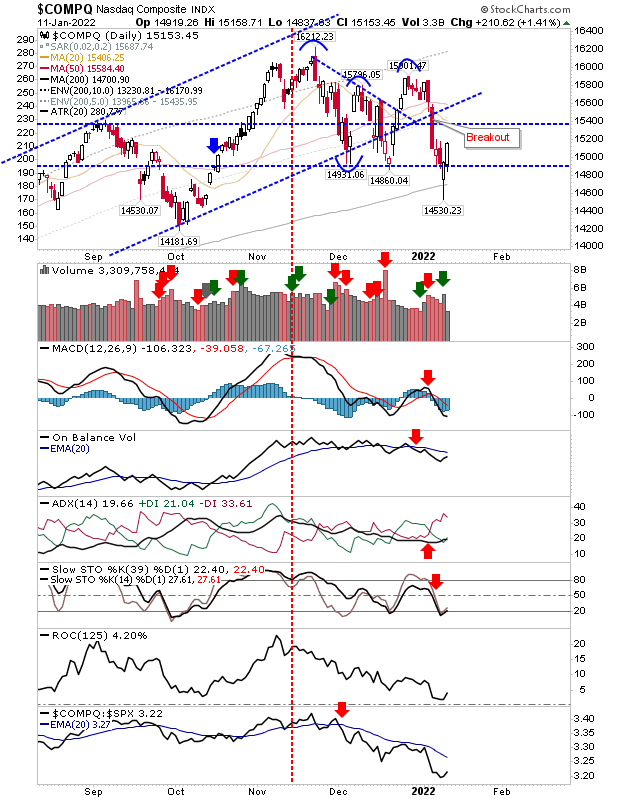

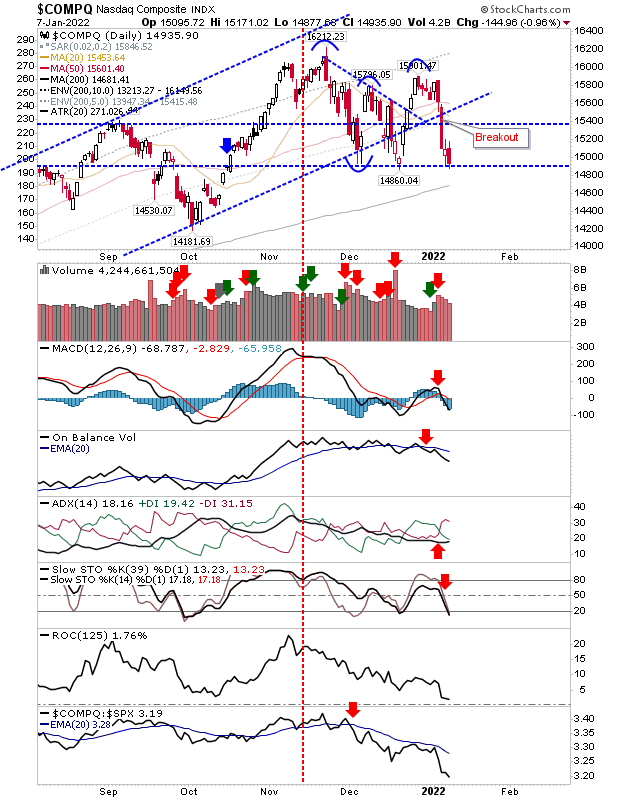

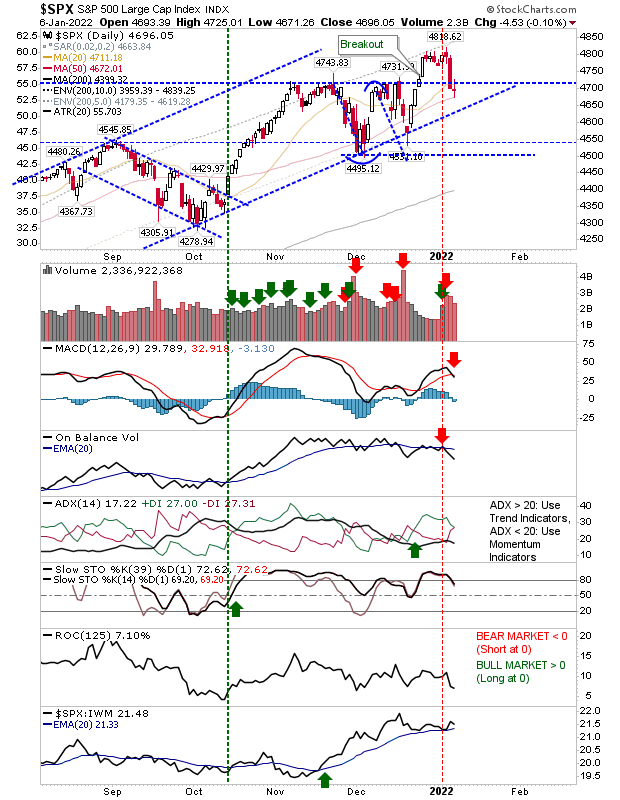

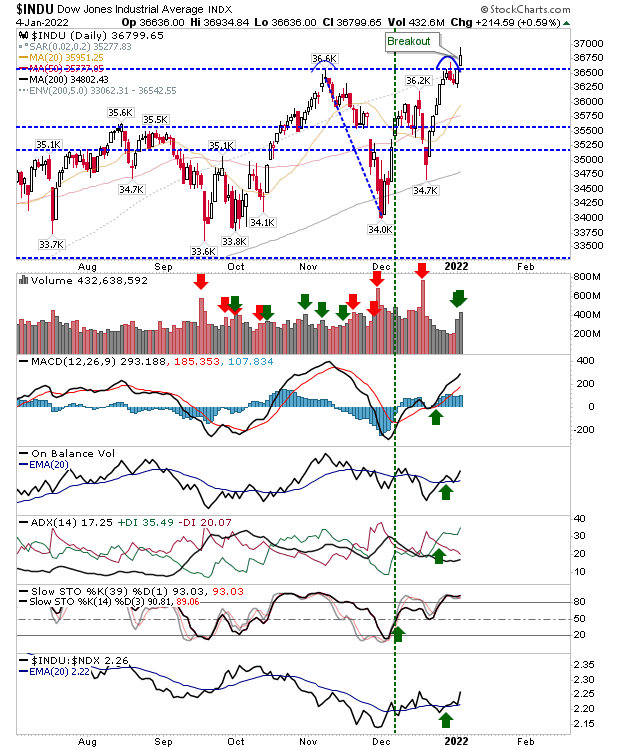

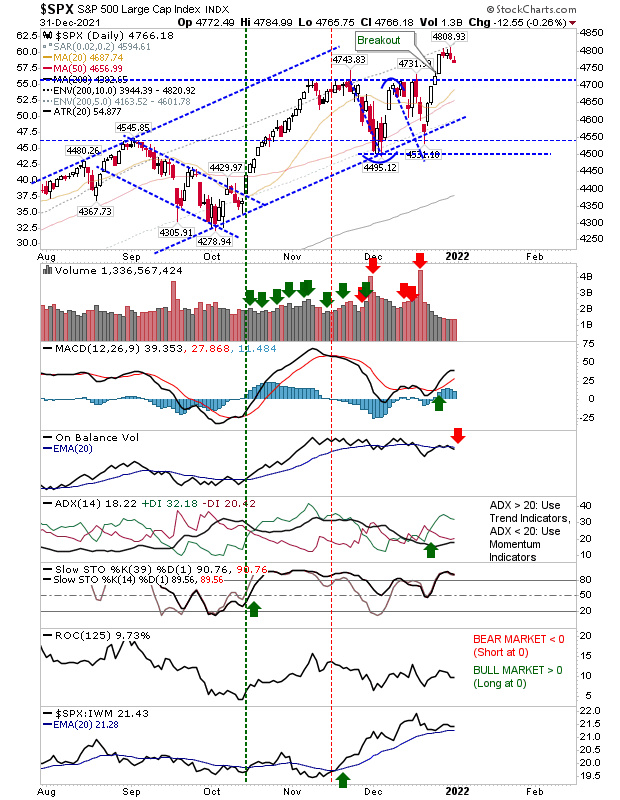

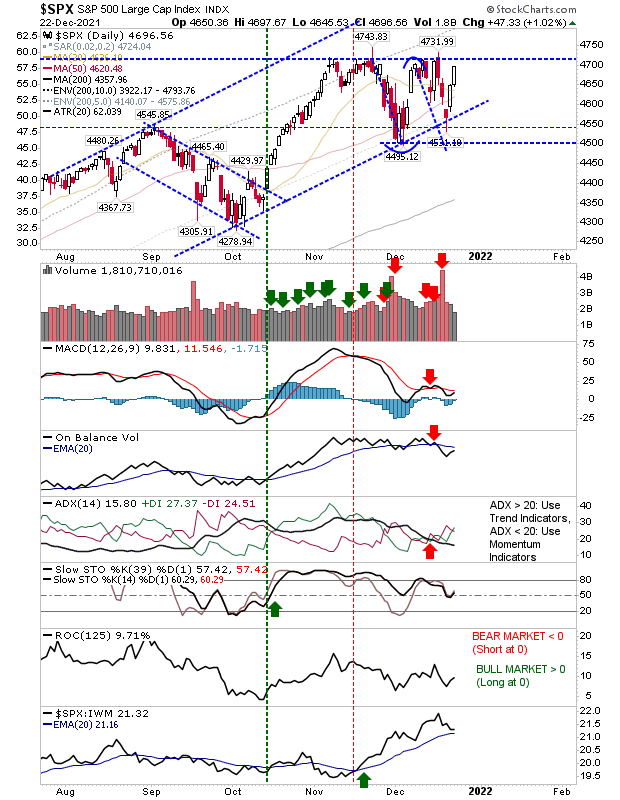

Relief Rallies stall for now

No surprise given the selling which has come before that the nascent rallies now find themselves moving into areas of prior supply. Today's candlesticks are not great but are more neutral in tone than outright bearish. For the Nasdaq, we had a bearish 'black' candlestick below all key moving averages. Supporting technicals are all bearish and there hasn't been enough of a recovery in relative performance to suggest this bounce can last much longer.