And so it begins, markets initiate a rally

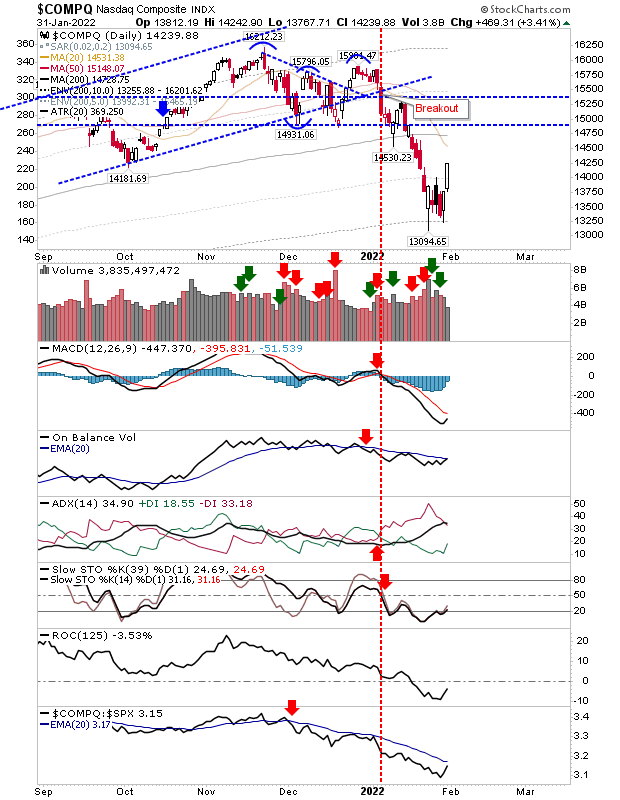

Buyers stewed over the weekend and started Monday with a period of buying across lead inside. Buying volume was down on yesterday's (and recent buying) and given the Nasdaq gained over 3% it was a little disappointing not to see volume match the large percentage gain, although things were a little better for the S&P.

For the Nasdaq, there was no fresh 'buy' signals, although On-Balance-Volume is on the verge of a new trigger.

The S&P edged above the December swing low and a return above its 200-day MA, although it was interesting to see the relative performance dip a little against the Russell 2000.

The Russsell 2000 also gained on low volume as buyers took advantage of Friday's trading. While the index is underperforming against its peers (S&P and Nasdaq), it is gaining ground.

While today was a solid start to a swing low we can expect a more neutral candlestick over the coming days. Once this occurs we will want to see indices retain their gains and not drift back into a retest of Friday's lows.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.