Small Loses keep reign on markets

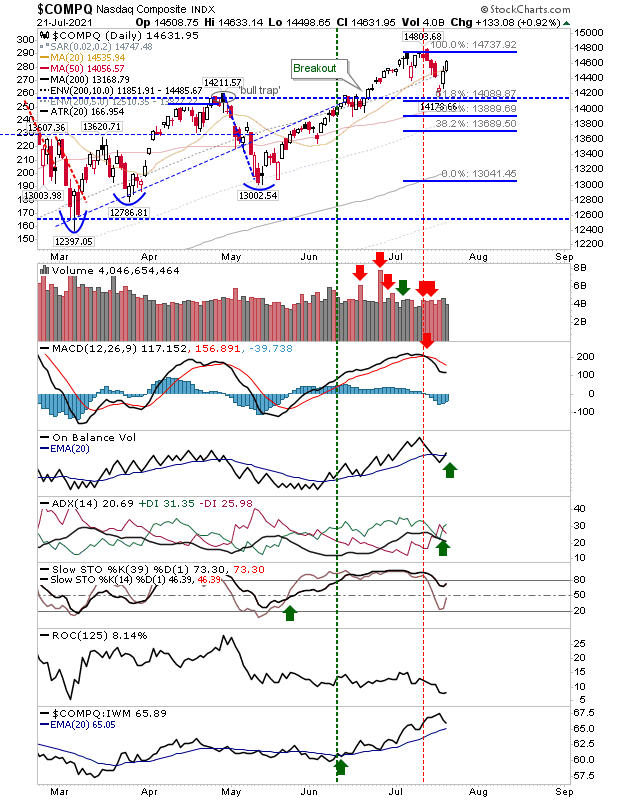

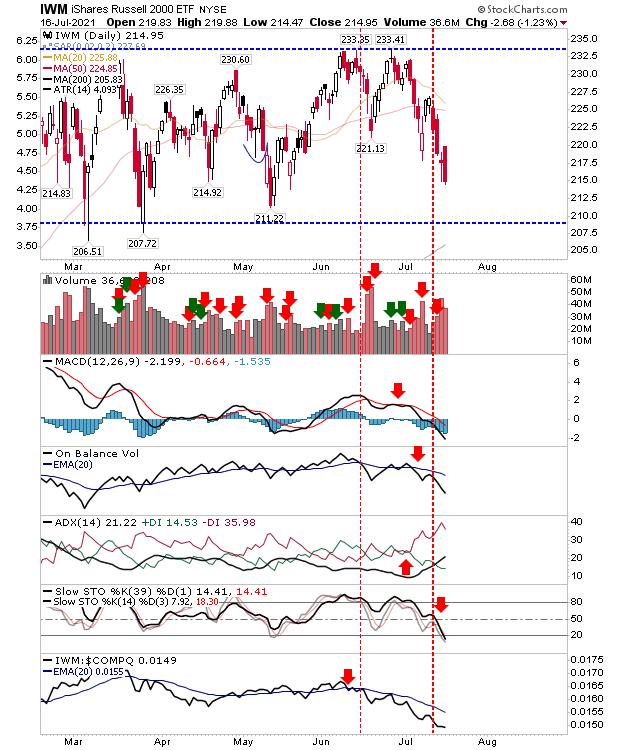

Markets still haven't pushed on since recovering from the loses in early July. Where we had the Russell 2000 struggling, now we have the Nasdaq looking weak. The S&P also took a little knock after a positive Thursday. In reality, we are probably looking at trading ranges and not any imminent collapse, and with (Covid curtailed) holidays in full swing it's hard to see where the demand buying is going to come from. At least with the Nasdaq there was support of the 20-day MA to lean on, although it didn't offer much support earlier in the month. The MACD is still on a 'sell' trigger as other technicals stayed positive.