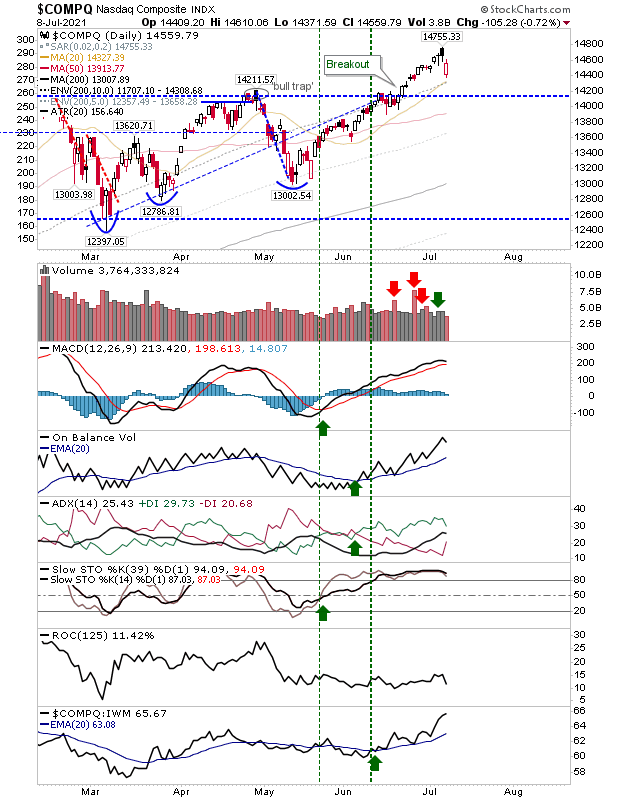

Sellers bring havoc to Russell 2000

Last week's bounce from the swing low looks to be toast with today's distribution selling leaving the Russell 2000 just a few points above that swing low. The net result from today was to leave technicals net bearish with the lows of March the next target.