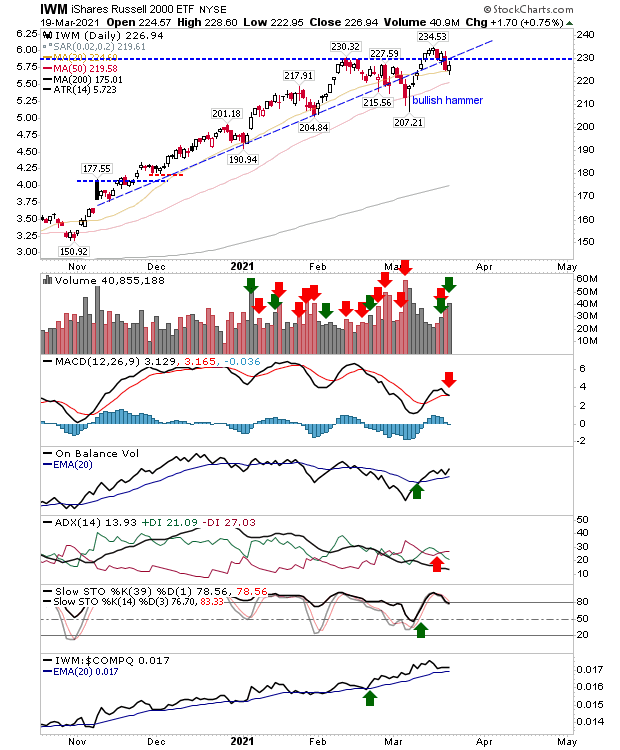

More damaging action in the indices today as sellers found little in the way of blockers to push both the Russell 2000 and Nasdaq lower. We haven't seen much from sellers since February, particularly in the Russell 2000. The Russell 2000 didn't pause at its 50-day MA as it makes its way toward the spike low from early March. Given the rate of decline I would expect this to surpass the low and start a longer move down towards its 200-day MA. Volume climbed to register as distribution. j Certainly, there are the makings of a trading range wit the 200 level looking nnlike the low end of the range The Nasdaq was another hard hit index as it shapes a mini-"z" measured move lower. This index has struggled since an attempted swing low in early March and now finds itself staring at a possible move to its 200-day MA. There were 'sell' triggers in the MACD and Stochastic, but relative performance against the Russell 2000 has been gaining sharply, so while this inde...