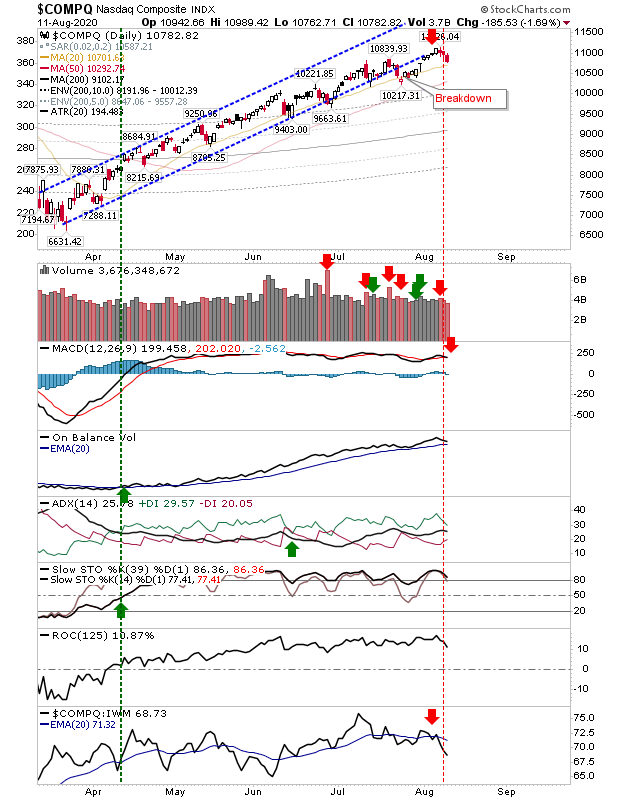

Rallies Accelerate Without Volume

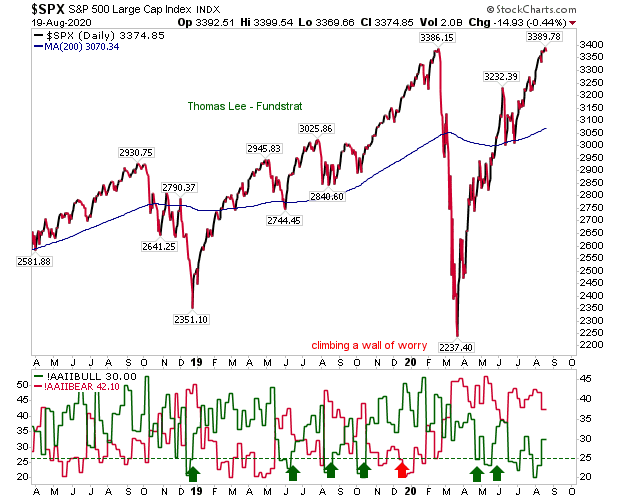

Hard to know what to make of today's action. For Large Cap and Tech Indices there was a pick up in the rate of buying, but the volume to go with the buying was below average - even allowing for holiday (Covid19 holiday) trading. The Russell 2000 didn't manage to post a gain but didn't suffer too much damage. The S&P has moved into the 15% zone and is close to the 10% range of historic overbought price relative to its 200-day MA dating back to 1950. The last time it was this overbought was February 2020, and before that it was January 2018; both times soon followed by periods of downside (back to the 200-day MA at the very least). Supporting technicals, including relative performance to the Nasdaq and Russell 2000, are strongly moving in bulls favor so we have very little in the way of early warning that weakness is coming so we should pay attention to relative performance to the 200-day MA metric.