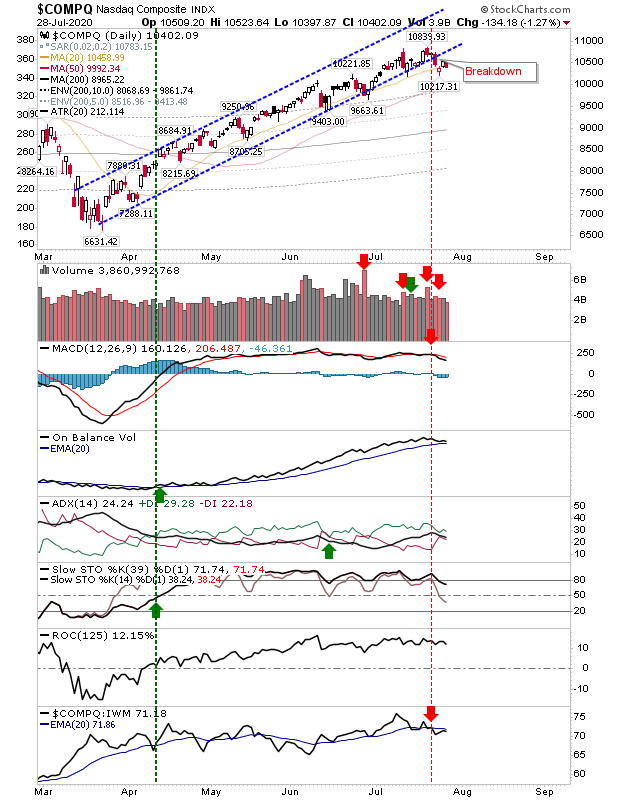

Russell 2000 Breakout on Daily and Weekly Timeframes

The Russell 2000 manged both to finish the week with a breakout on the Friday and a breakout on the weekly chart. The only downside was the the lack of volume, although volume registered as accumulation on the daily chart.