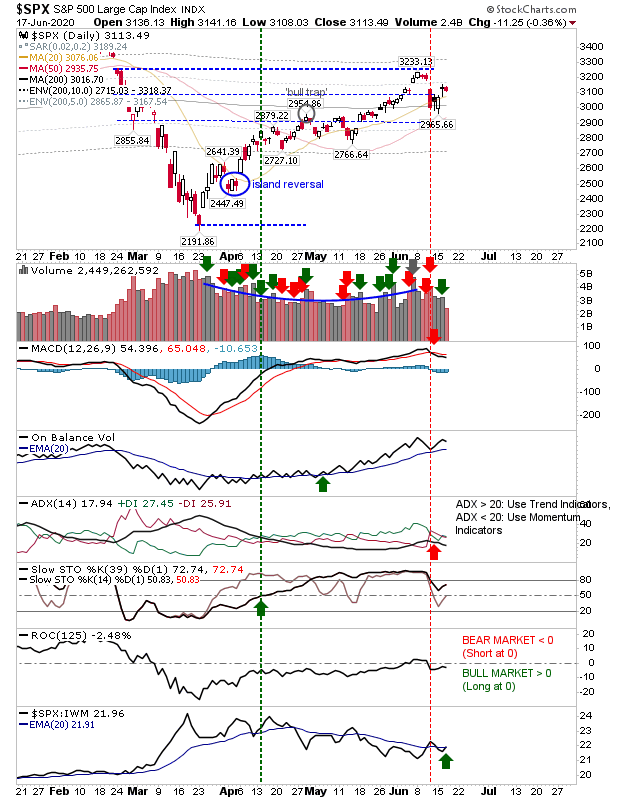

Buyers attempt to defend support

Sellers had managed to push indices back to support levels where buyers are looking to make a stand. The S&P is down at the June swing low which is also the 50-day MA. Technicals are a mix of bullish and bearish signals; the index is still underperforming against Small Caps. Selling volume in recent weeks has sided heavily with bears but On-Balance-Volume hasn't yet switched to a 'sell' trigger. This is as good as place as any to stage a bounce and take on a low risk trade.