Friday's Recovery Pauses The Profit Taking

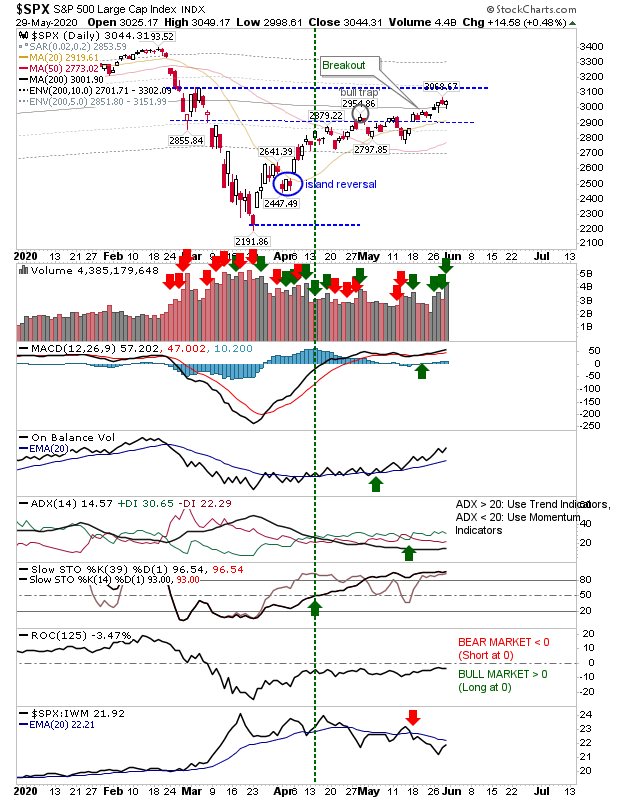

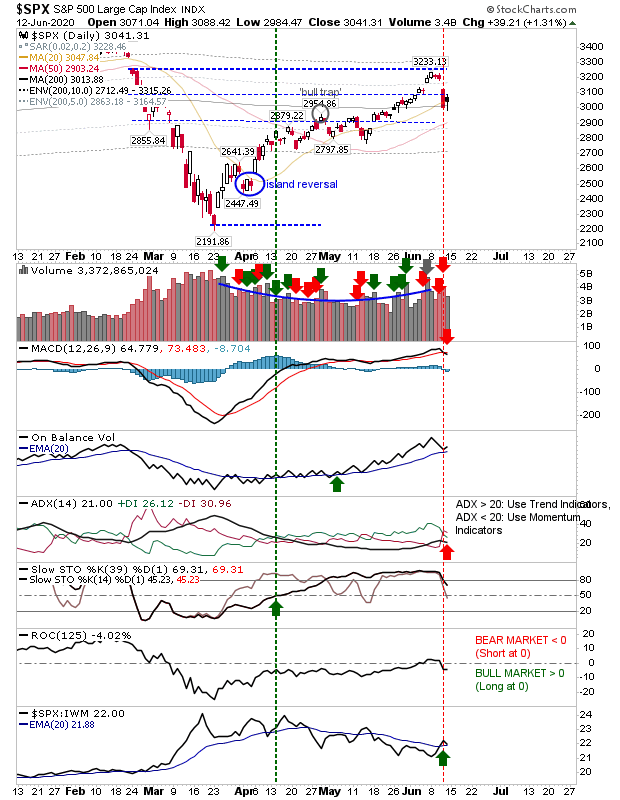

Traders took stock on Thursday's sharp falls with some modest buying. Collectively, Thursday-Friday's paired action might be viewed as a bullish harami across indices, and therefore a swing low. But, I would like to see markets oversold for this to be a proper swing low and this is not the case for markets now. The S&P fell back to its 20-day MA but is caught between support and resistance. Technicals are a mix of bullish and bearish indicators with 'sell' triggers in the MACD and trend measure, ADX (-DI > +DI). However, bullish is the accumulation trend in On-Balance-Volume and the relative outperformance against the Russell 2000 (although this is bearish for the broader market, at least it's bullish for safety conscious Blue Chip stock buyers).