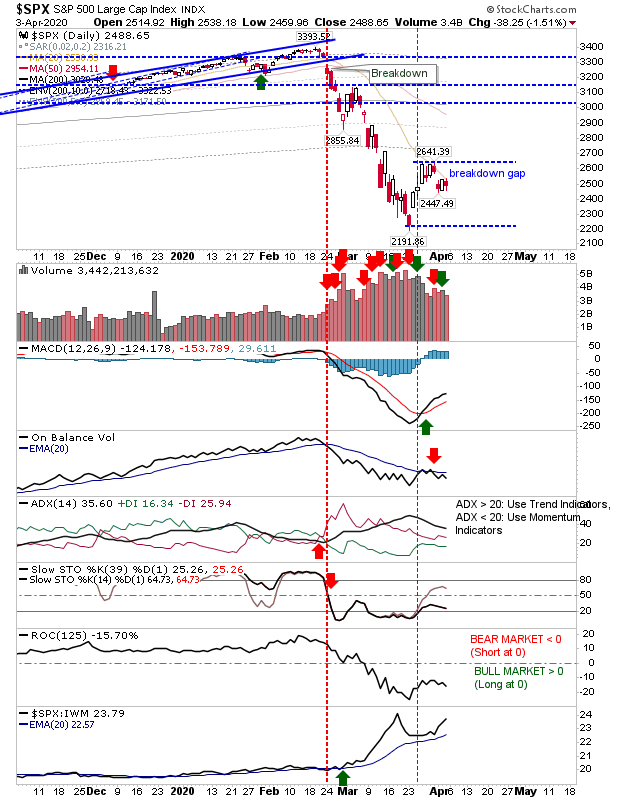

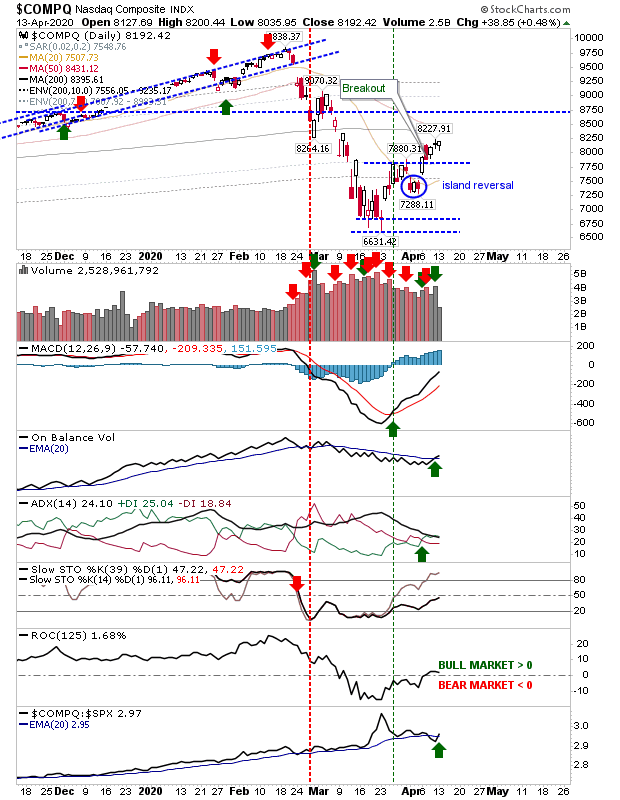

Russell 2000 Diverges From Nasdaq; But Breakout Holds

Some low key selling from indices other than the Nasdaq, but not enough damage to reverse the breakouts. Bulls still doing enough to keep the bounce intact. Starting with the positive, the Nasdaq finished a little higher with a bullish hammer and a relative out-performance advantage against the S&P; although the 'bullish hammer' is not a true hammer because momentum is not oversold.