Breakdown Gaps Remain, But Selling Doesn't Accelerate

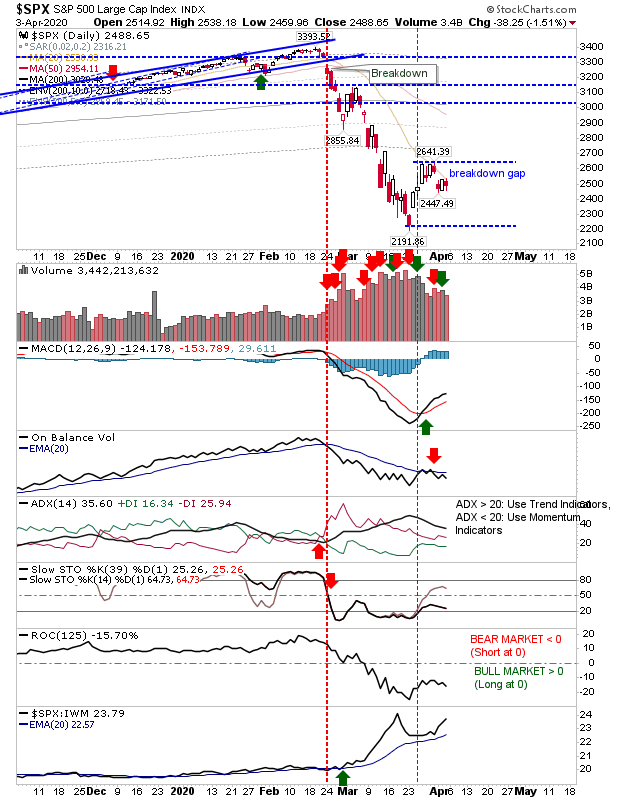

While Friday was a day for sellers, it didn't undercut the initial lows established by the breakdown gaps. While markets remain in a short period of stasis, given recent volatility, they are unlikely to remain there for long. Selling volume was down from Thursday's buying, but given the breakdown gaps haven't really been challenged, the expectation is that markets will continue lower as part of an initial retest of March lows.

For the S&P, there is a well established MACD trigger 'buy', parlaying against a 'sell' trigger in On-Balance-Volume, but a fresh acceleration in relative performance against more speculative Small Caps. What money is flowing to the market does appear to be going into more defensive Large Cap stocks.

The Nasdaq, likewise had a day similar to the S&P, although it did lose a little relative ground to the S&P index. It remains under distribution as marked by On-Balance-Volume, although Friday's selling was relatively light. A negative ROC keeps this in bear market territory, with only the MACD offering a 'buy' trigger of the Trend/Momentum/Volume indicators I track.

Small Caps did suffer an intraday spike which generated fresh 3-day lows, but recovered enough by the close of business to keep the selling relatively orderly. However, challenging the breakdown gap could still take a while, and On-Balance-Volume is on a 'sell' trigger.

The Semiconductor Index did make some inroads into the breakdown gap but not enough to fully close the gap - however, of the primary indices it remains the index best able to negate the breakdown gap.

This week will be about monitoring breakdown gaps and seeing if they close - or if (more likely) markets continue their descent towards March swing lows. Again, we are still in the very early stages of a bear market and there is still lots of work still to do before we reach the end.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

For the S&P, there is a well established MACD trigger 'buy', parlaying against a 'sell' trigger in On-Balance-Volume, but a fresh acceleration in relative performance against more speculative Small Caps. What money is flowing to the market does appear to be going into more defensive Large Cap stocks.

The Nasdaq, likewise had a day similar to the S&P, although it did lose a little relative ground to the S&P index. It remains under distribution as marked by On-Balance-Volume, although Friday's selling was relatively light. A negative ROC keeps this in bear market territory, with only the MACD offering a 'buy' trigger of the Trend/Momentum/Volume indicators I track.

|

The Semiconductor Index did make some inroads into the breakdown gap but not enough to fully close the gap - however, of the primary indices it remains the index best able to negate the breakdown gap.

This week will be about monitoring breakdown gaps and seeing if they close - or if (more likely) markets continue their descent towards March swing lows. Again, we are still in the very early stages of a bear market and there is still lots of work still to do before we reach the end.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.