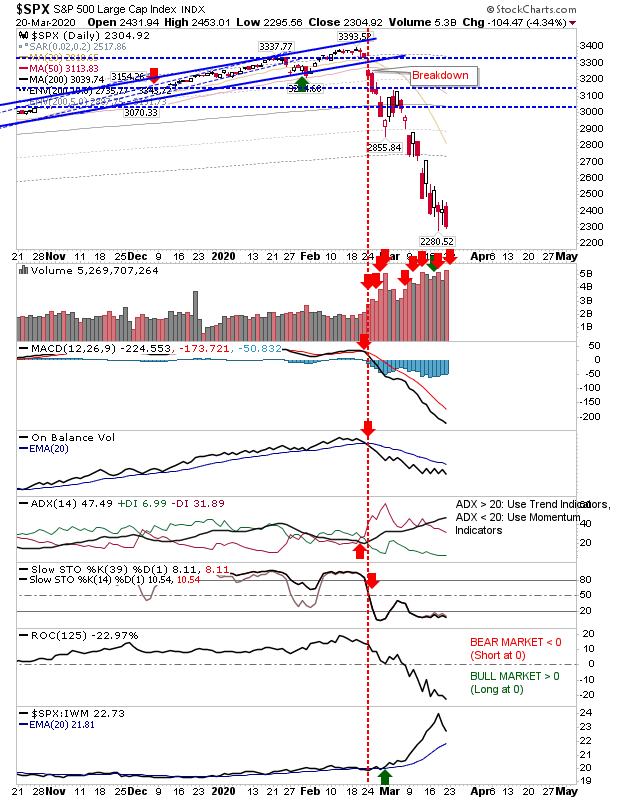

Today Wasn't The Swing High For The Bounce

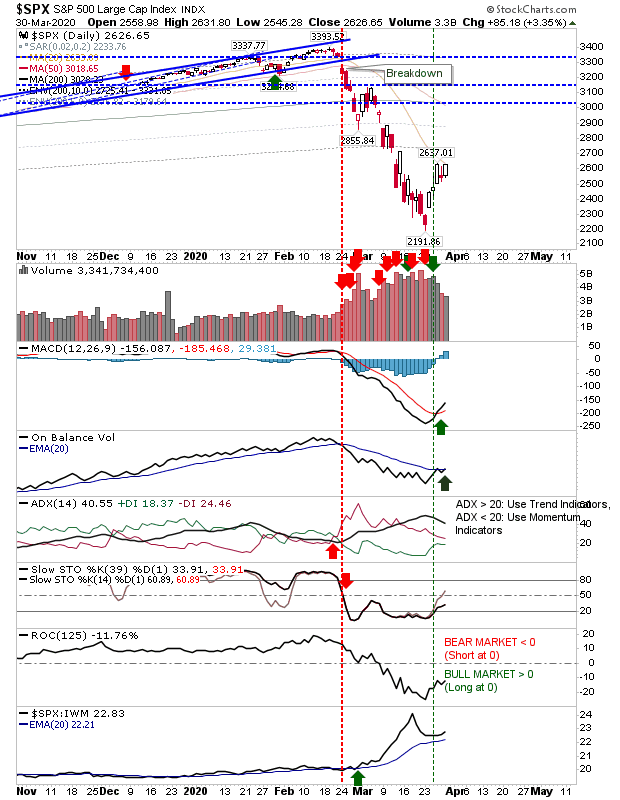

Friday's bearish doji had the natural look of a swing high for a bear bounce given the midline tag for stochastics and 20-day MA resistance - but this wasn't the case. In the end, it was another solid day of buying, bringing indices back to Thursday's highs. However, despite today's gains, buying volume was light and technicals remain mixed. For the S&P, despite the lighter volume there was enough volume to reverse the 'sell' trigger in On-Balance-Volume.