Still grasping for a swing low

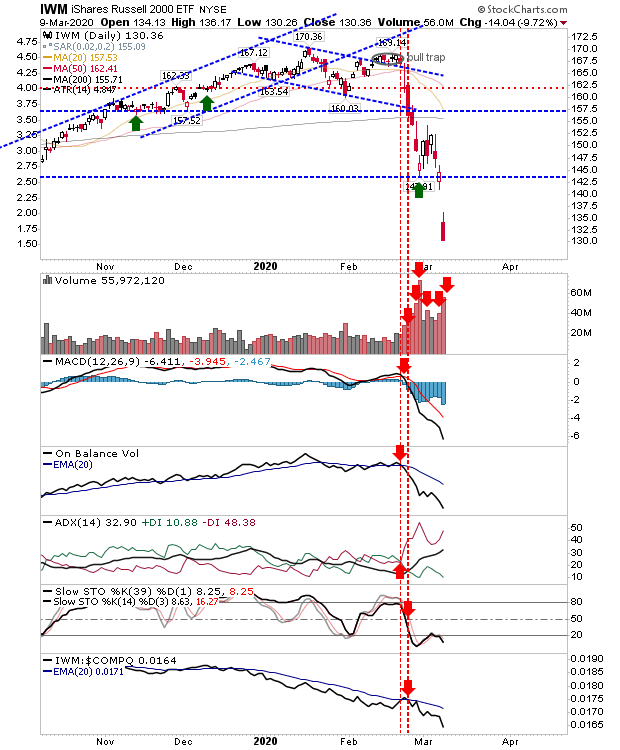

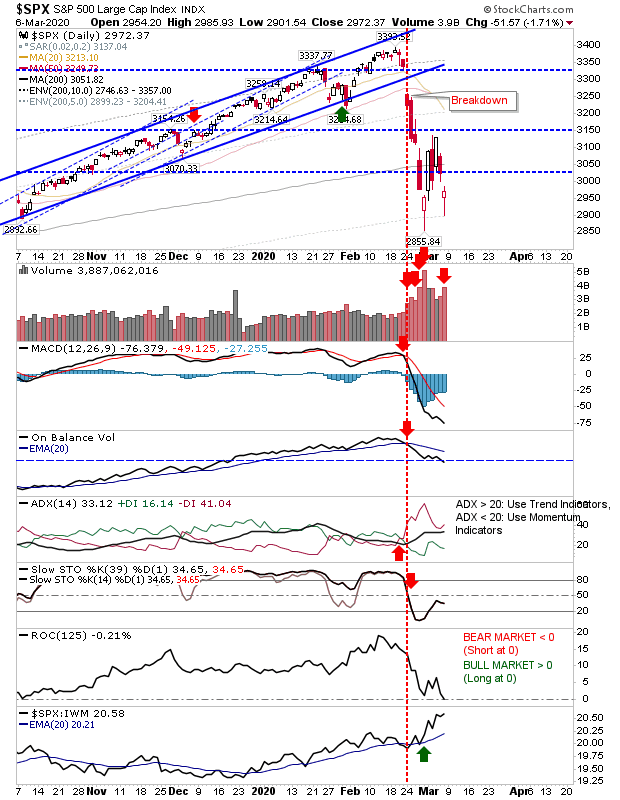

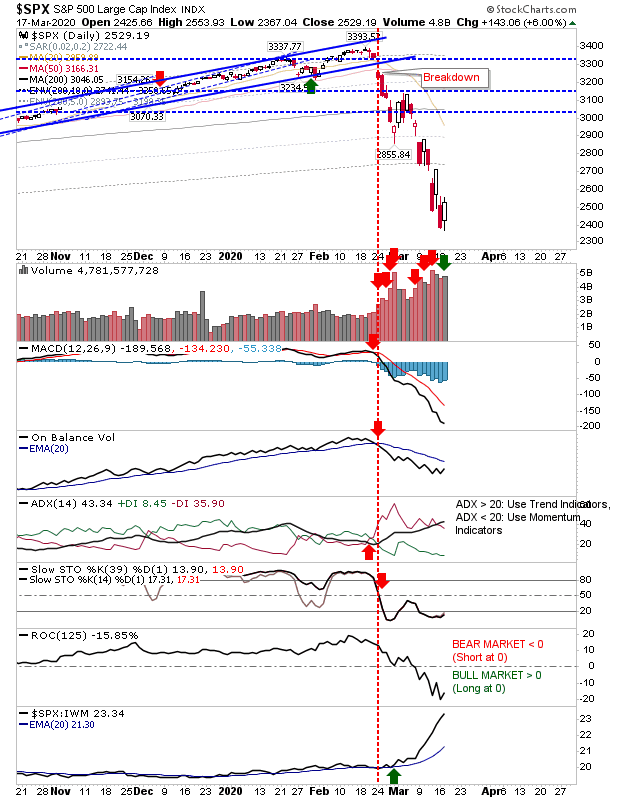

Markets continued their downward leg in an attempt to an establish a low. For example, the Russell 2000 has already given up 35% from its highs and today's candlestick didn't suggest a capitulation (it looked better on Friday). For many of the indices there are no developing divergences to work with and there hasn't been any semblance of a bounce to establish a sideways consolidation of losses, so we are still looking for a swing low to work off. The S&P did register as an accumulation day and managed a reversal of yesterday's losses, but aside of that there wasn't much more to say. The S&P has comfortably surpassed the 5% zone of historic weak action, but to hit the 1% zone would require a tag of 2,223.