The Ideal Long Term Investors Market

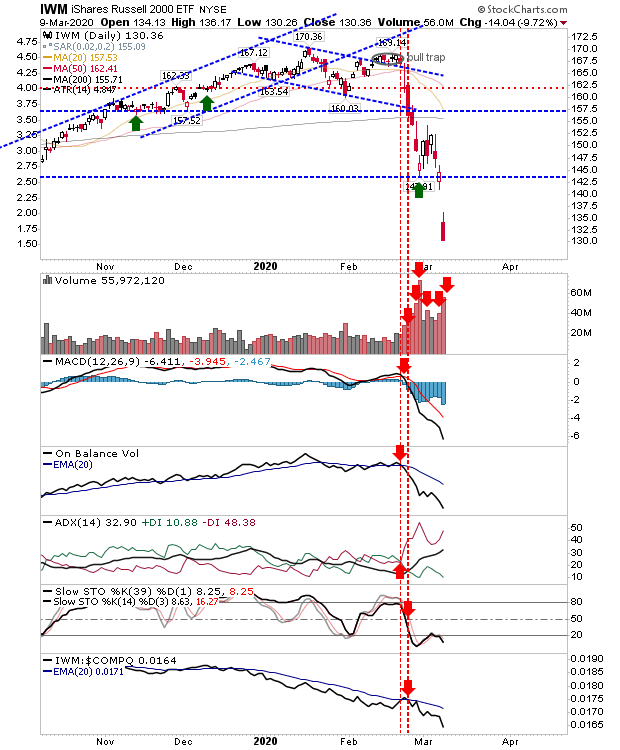

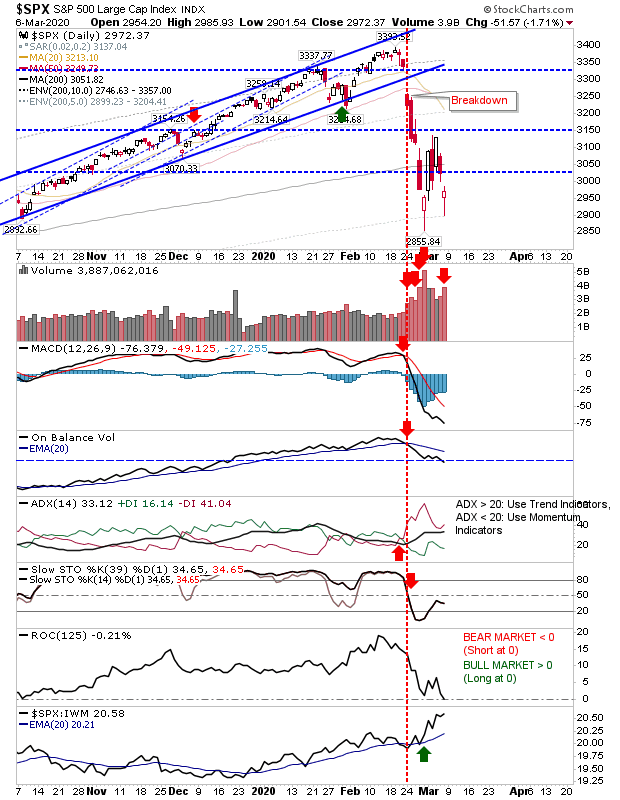

Markets are still working through their declines as they seek a point of seller's exhaustion. The Russell 2000, as the index of speculative stocks, is the one to watch for leads. Today's 6%+ loss undercut the prior low and left the index grasping for a low. On the plus side, selling volume was lighter than yesterday's buying volume and the index is now 19% away from its 200-day MA; if it gets to 21% - which could happen tomorrow - it would leave it in the 1% zone of historic weak action and should be considered an incredible buying opportunity for investors with a multi-year time frame; even now, it has already surpassed the 5% zone, and investors should be active accumulating Small Cap stocks. Short term traders may also reap benefits if they have the stomach for the volatility.