Russell 2000 Stages Recover

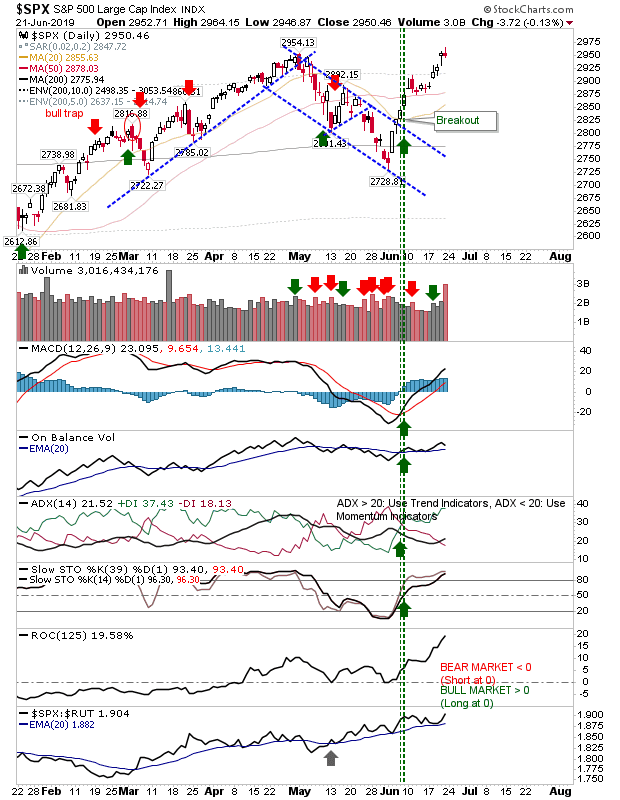

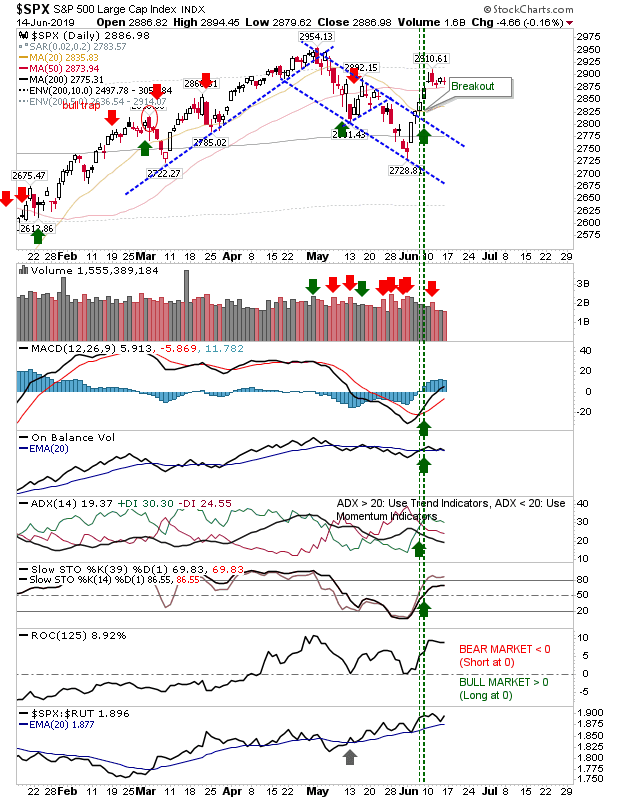

A much needed boost to Small Caps gave value buyers a shot in the arm as the Russell 2000 gained nearly 2%, returning it above 200-day and 50-day MAs. It was an important recovery which wasn't quite mirrored by peer indices, but such indices are in much better shape.