Trump punches Santa in the stomach

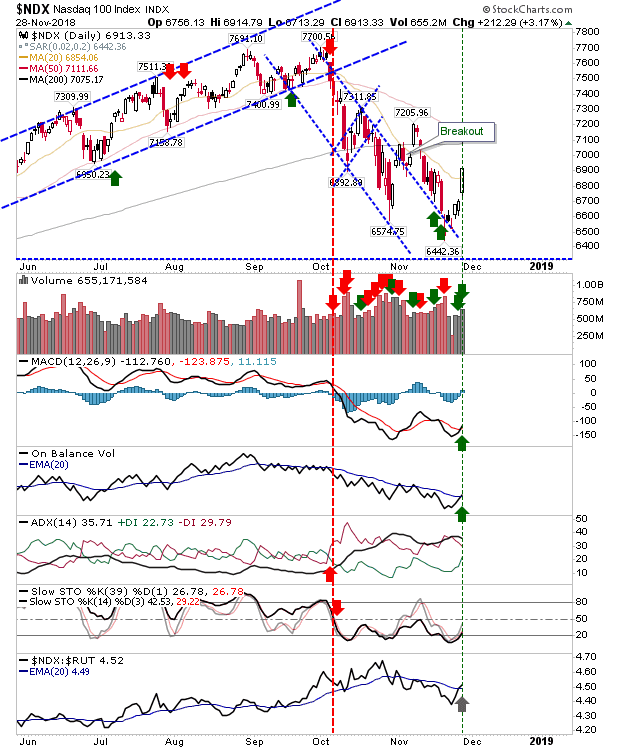

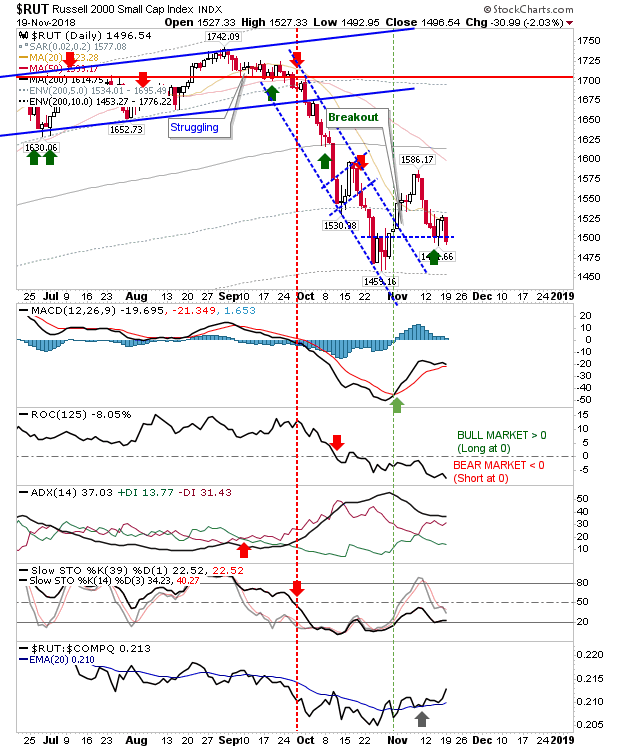

Well, that didn't last long, Trump's comments on Chinese tariffs stuck a knife in the rally but the damage wasn't total. Anyone who shorted or sold the resistance test in the S&P will be happy, but breakout buyers in the Nasdaq will have been stopped out as a 'bull trap' is confirmed. The S&P gave up both the 50-day and 200-day MAs as the rate-of-change remained in sub-zero territory throughout the rally. Both the MACD and On-Balance-Volume are holding on to their bullish signals but there needs to be a sharp recovery (starting Thursday) if these signals are to hold. Investors were offered another 'buying' opportunity as part of the buying the dips after the Oct/Nov 'buy' signals.