The

Fed stepped in at a good time with positive comments on rate increases as markets put some distance on recent swing lows. All markets now have a bit of wiggle room to defend and with seasonal 'Santa Rally' ready to kick off then we yet have more good news to come.

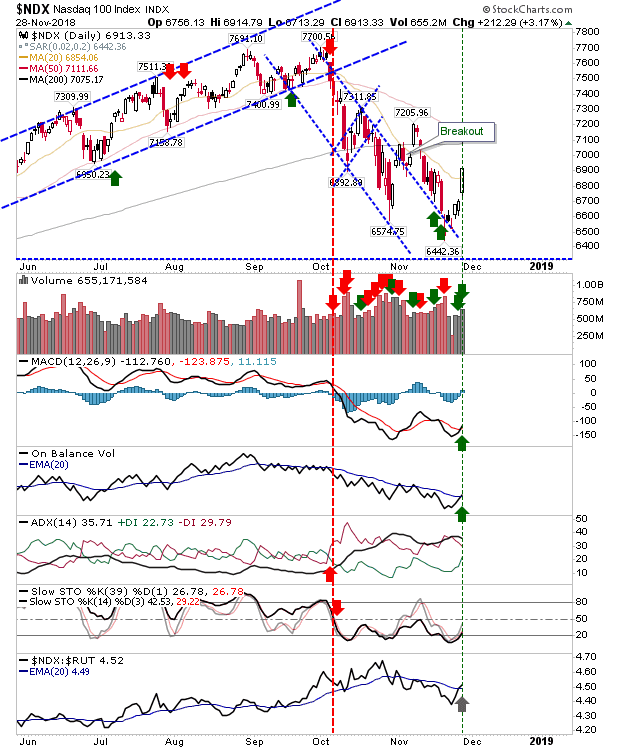

The biggest one-day gain was the Nasdaq 100, it gained over 3% on higher volume accumulation. These gains came with a bullish cross in relative performance against the Russell 2000 and 'buy' signals for the MACD and On-Balance-Volume. The first test will be the convergence of 50-day and 200-day MAs around 7,100.

The Nasdaq also enjoyed bullish 'buy' signals for the MACD and On-Balance-Volume. It may be a slow grind but a test of 50-day and 200-day MAs is looking ever more likely.

Large Caps did not disappoint. The S&P enjoyed a bullish cross of On-Balance-Volume and MACD. There was also a bullish cross in the relative performance against the Russell 2000. The S&P is very close to testing overhead resistance of 50-day and 200-day MAs.

Small Caps also gained 2.5% and enjoyed a MACD trigger 'buy'. As a part of this move it does look like the Russell 2000 has returned to a period of underperformance against Nasdaq indices but the groundwork is there for a recovery rally even if the rally was to lag behind that of Tech indices.

For tomorrow, look for some consolidation near Wednesday's highs as part of a setup for a new intermediate-term rally. The mini-November swing peaks (which would form the neckline double bottoms) are an initial target - along with 200-day MAs if the latter is lower. Those who availed of the investor 'buy' signal on

October 25th should be in the green after today.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter