Russell 2000 digs in again - Fresh 'Buy' for Thanksgiving

It could have been better but bulls should be happy with the work done in the Russell 2000. Yesterday's close pushed the index into the 10% zone of historic weak action (reached in October 2018) while also confirming a double bottom on a two-bar reversal. It's a second 'buy' signal after last Thursday's failed.

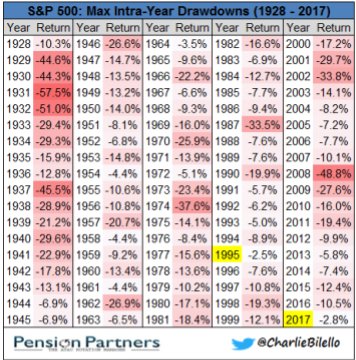

The S&P wasn't so lucky as it struggled to bounce off its double bottom. Black candlesticks are rarely good to see, and with a distinct lack of support below it could prove problematic after Thanksgiving. Technicals are all bearish, including a bearish swing in relative performance to the Russell 2000. There are three tiers of support drawn and the index has - so far - defended the second level. On a more positive note, the index dropped into the 15% zone of historic weak action, marking it as an accumulate for investors.

The Nasdaq is struggling more than the S&P and while it remains in the accumulate zone for investors, it just missed out Tuesday from entering the 10% zone of historic weak action. Technicals have nothing to offer bulls, each showing marked accelerations lower. While investors should be dabbling here there is a good chance things could get worse here.

The Dow Industrial Average is resting on a support zone, offering another 'buy' opportunity. There is no 'black' candlestick but watch for a gap down - although Thanksgiving Friday is typically a feelgood mini-rally - it may be Monday or Tuesday before the market's true intentions are shown.

For Frdiay, look for a small rally to keep the junior trader's happy but it may be Monday or Tuesday until we know how strong of a new swing low markets created today. Traders will have had one stop out from last Thursday, will today be another?

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

.

The S&P wasn't so lucky as it struggled to bounce off its double bottom. Black candlesticks are rarely good to see, and with a distinct lack of support below it could prove problematic after Thanksgiving. Technicals are all bearish, including a bearish swing in relative performance to the Russell 2000. There are three tiers of support drawn and the index has - so far - defended the second level. On a more positive note, the index dropped into the 15% zone of historic weak action, marking it as an accumulate for investors.

The Nasdaq is struggling more than the S&P and while it remains in the accumulate zone for investors, it just missed out Tuesday from entering the 10% zone of historic weak action. Technicals have nothing to offer bulls, each showing marked accelerations lower. While investors should be dabbling here there is a good chance things could get worse here.

The Dow Industrial Average is resting on a support zone, offering another 'buy' opportunity. There is no 'black' candlestick but watch for a gap down - although Thanksgiving Friday is typically a feelgood mini-rally - it may be Monday or Tuesday before the market's true intentions are shown.

For Frdiay, look for a small rally to keep the junior trader's happy but it may be Monday or Tuesday until we know how strong of a new swing low markets created today. Traders will have had one stop out from last Thursday, will today be another?

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.