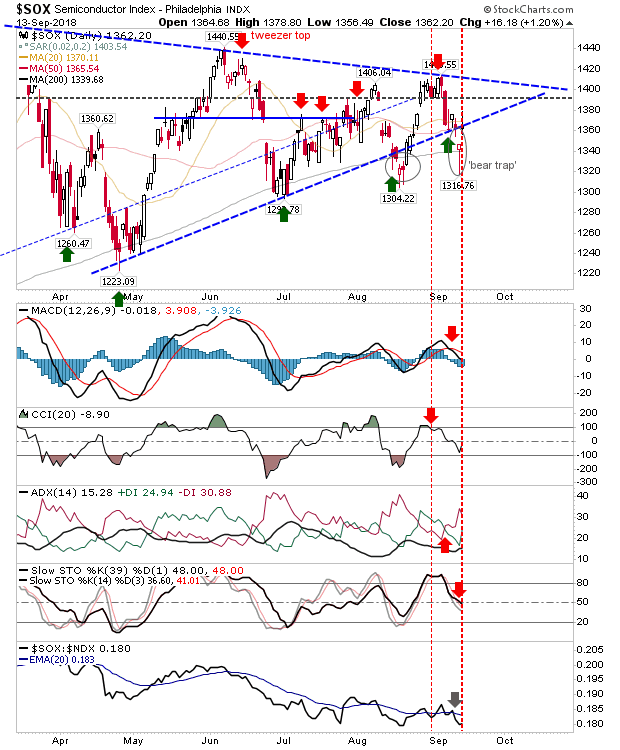

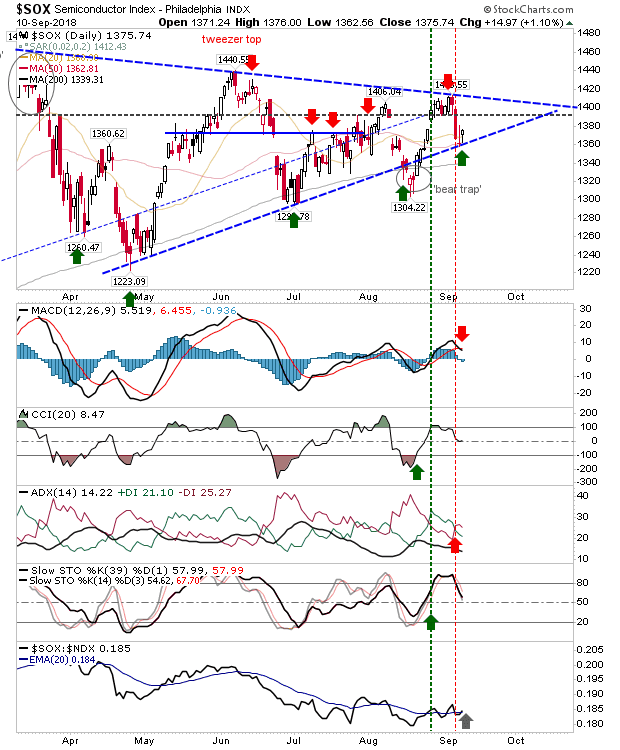

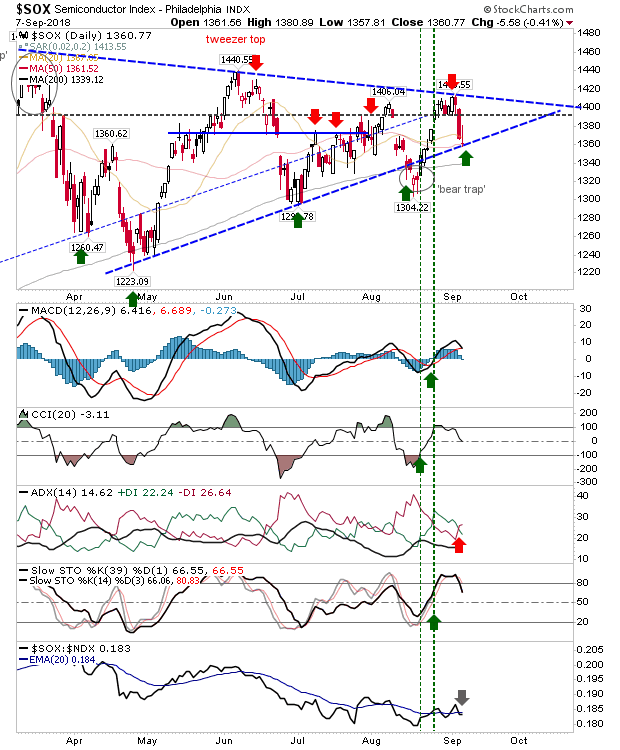

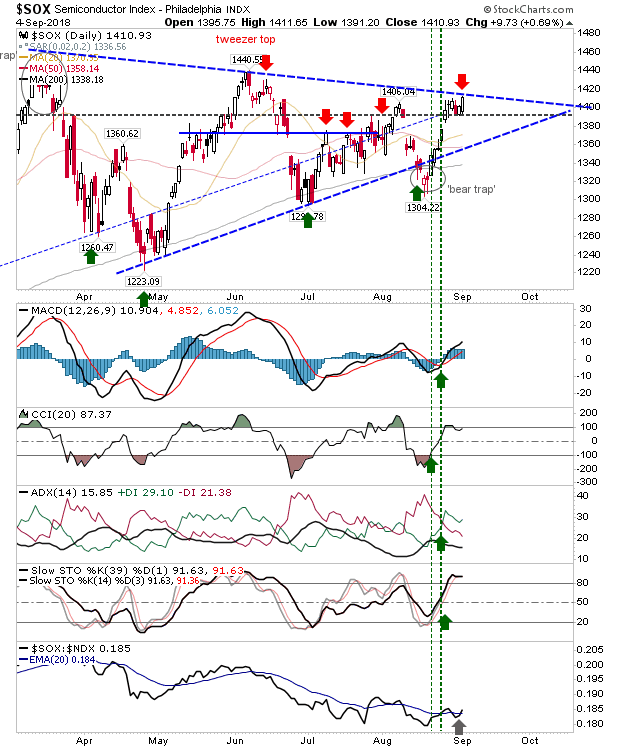

Semiconductors Firm Up a Swing Low

There wasn't a whole lot to Friday's action but two indices which were struggling a little did benefit. The Semiconductor Index gained 1% as it bounced strongly off the bullish 'morning star'. The consolidation triangle looks to be shifting to another pattern but resistance from triangle swing highs remains in effect and is the next challenge of the index. Technicals are net bearish and relative performance, while recovering, hasn't yet undone the most recent 'sell' trigger.