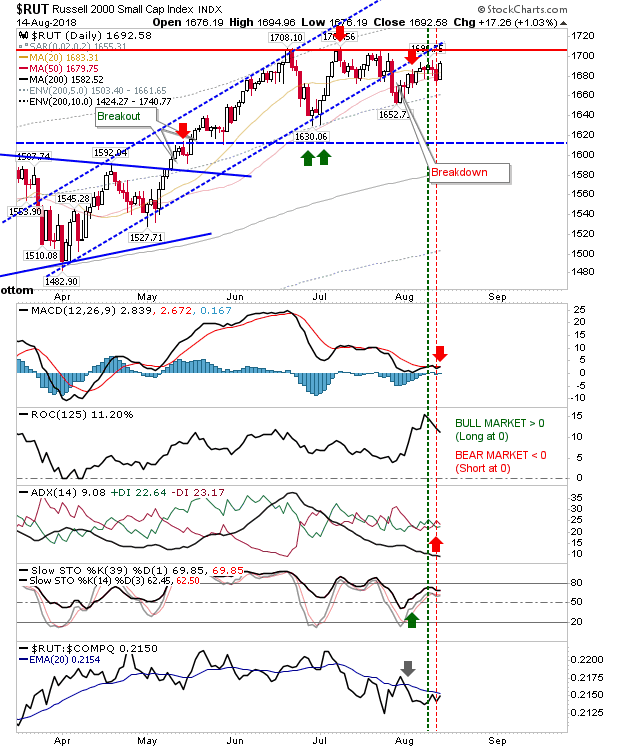

Markets Rally In My Absence; Dow and S&P Opportunity.

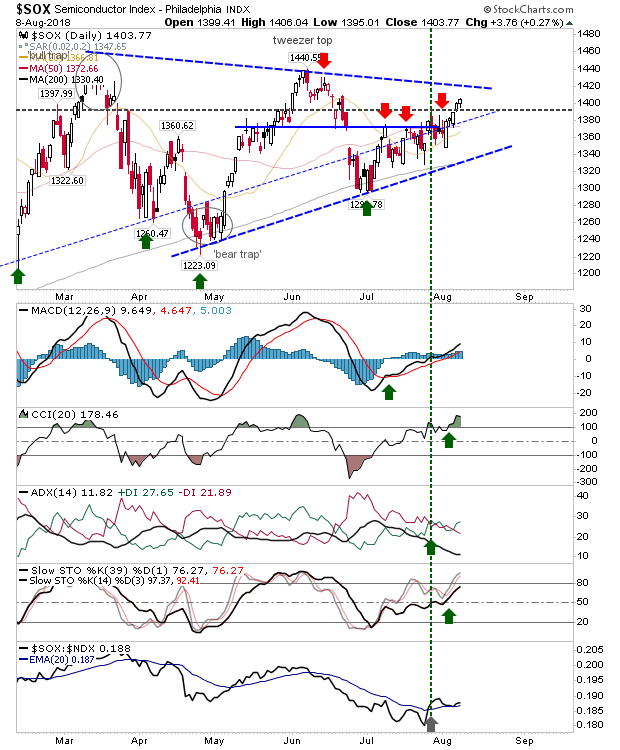

Before my vacation I had noted three indices to watch undergoing support tests: Semiconductors, Nasdaq and Dow Jones Industrial Average had all presented buying opportunities. However, I had also thought these rallies would stall out when they got back to resistance - this did not prove to be the case. With the exception of the Semiconductor Index (which did rally), all indices managed to post new highs for the summer. The Semiconductor Index is the one which may present a profit taking opportunity (or a potential shorting chance) as it approaches triangle resistance. Given both the Nasdaq and Nasdaq 100 are at new multi-year highs and technicals for the Semiconductor Index are net bullish - and this rally begun from a 'bear trap' - chances are this will continue beyond 1,410 and go to challenge 1,440 and likely more.