Stage Set for a Rally

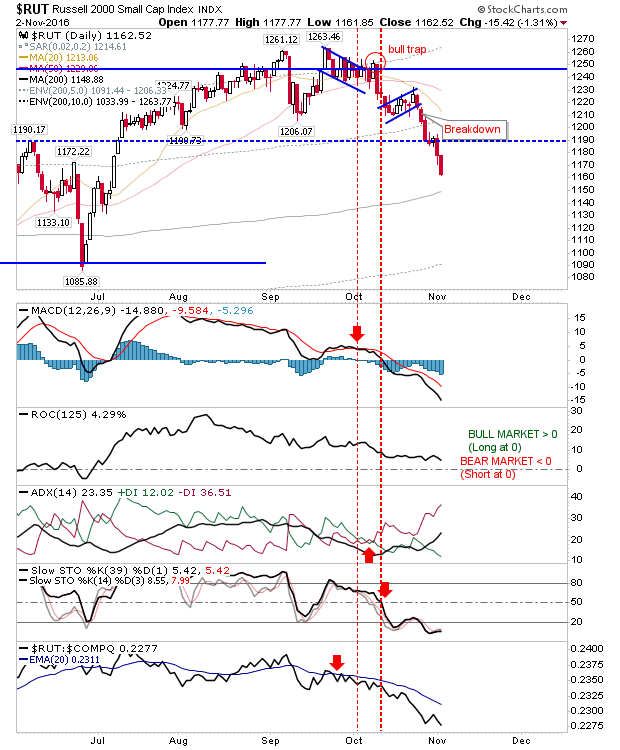

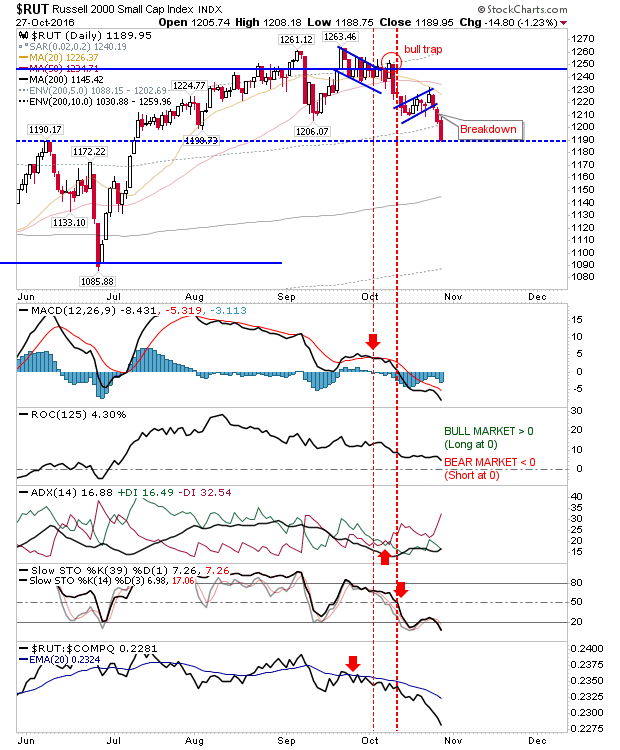

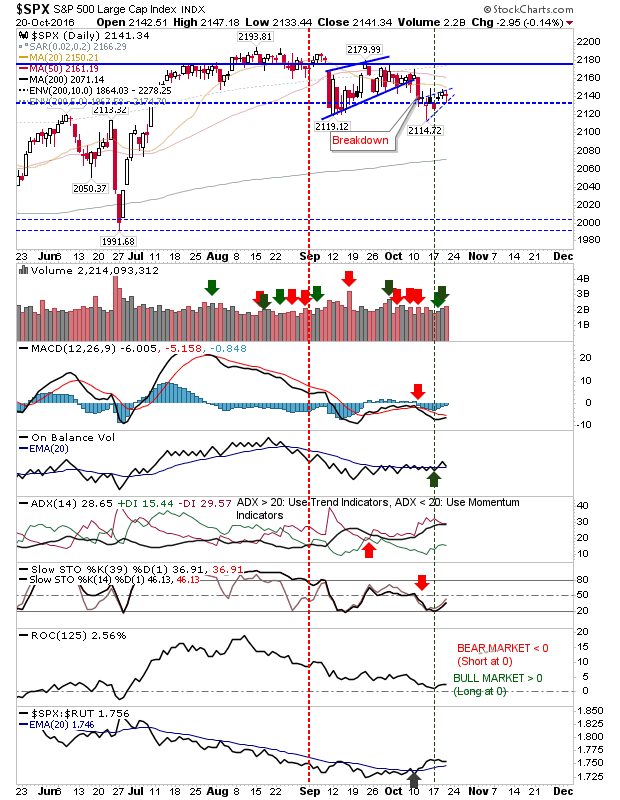

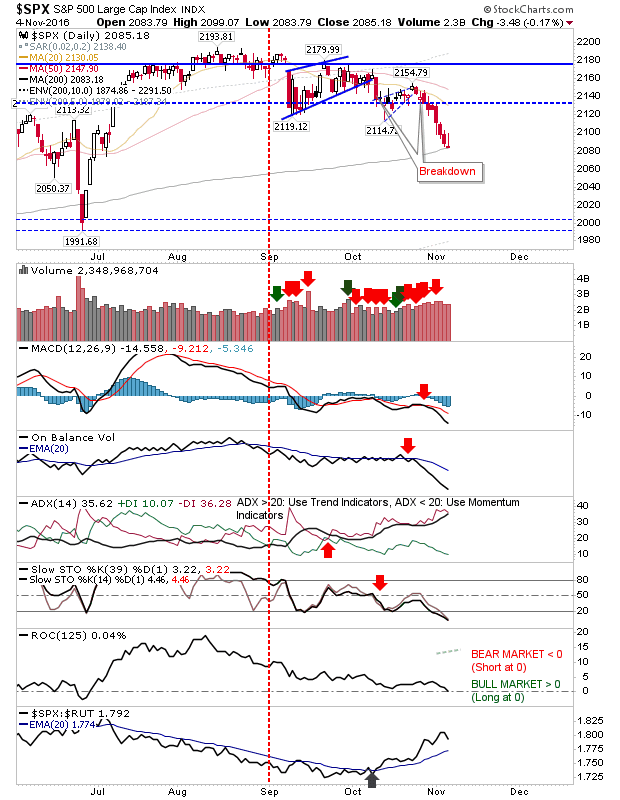

Friday delivered the tentative tests of the 200-day MA that markets had teased since breaking down from rising wedges. This has left markets in a good place for bulls to exploit on Monday. The S&P finished at the low of the day, but these 'inverse hammers' are typically viewed as bullish since while the S&P was unable to hang on to intraday gains by the close of business, there was no significant loss off the open price (i.e. no follow through down). Assuming there is no pre-gap lower on Monday (and even if there is, a buy just before the open might prove tempting), bulls could find themselves in a good position to trade into a probable Clinton victory.